Colonial Tap Company (CTC) is a manufacturer of taps and fittings for the plumbing trade, located in Brisbane. The Company was established by Ken Hall in 1951, with a workforce of 10, to meet the needs of the post-war housing boom. Its product range was fairly limited but the company had an excellent reputation for quality.

Nowadays, CTC manufacturers an extensive range of high quality brass and chrome taps. The company is managed by Ken's son, Michael, and employs 20 people. It has annual sales averaging approximately $1million. Although it has been consistently profitable, CTC has experienced increasing pressure from competitors since the early 1990s. The company uses a cost-plus approach to pricing but is having to reduce its markup constantly in order to maintain market share.

Both Ken and Michael qualified as engineers. The business is small and has never been able to employ an accountant. Instead, a bookkeeper calculates monthly profit as sales revenue minus expenses. Prices are based on rough estimates of cost of direct material and direct labour inputs plus a 50% markup.

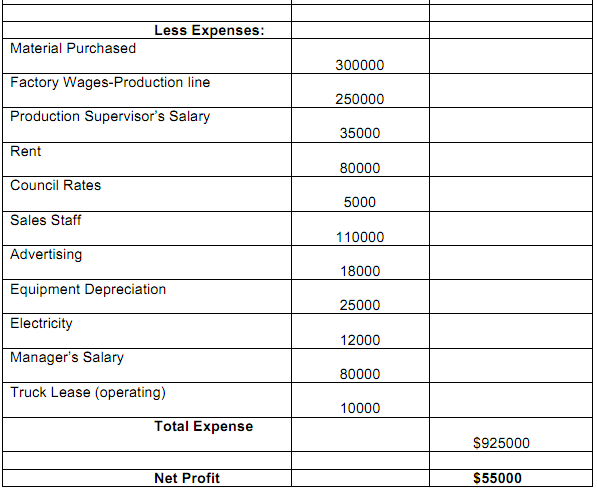

With the decline in profit and constant pressure on prices, Michael began to feel uneasy about the way costs and profits were calculated. The results for the month just ended were as shown in the table below:

Required:

Michael Hall asks you to review the results for the month and evaluate the company's approach to estimating product cost. In doing so, you should:

1. Comment on the cost classifications used in CTC's income statement.

2. Estimate the cost of goods manufactured and sold.

3. Prepare a revised income statement for the month.

4. Summarise the differences between your income statement and the one above.

5. Choose a more useful format for analysing costs than that used in your revised income statement.

6. Propose recommendations for changes.