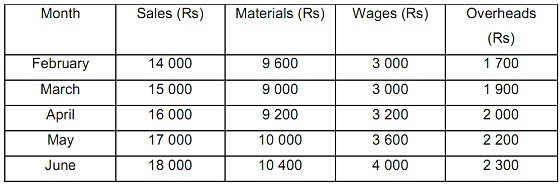

You are provided with the given information relating to Cello Ltd. The accountant is presently preparing the budget for the next three months ending 30 June 2010.

a) The credit terms are as shown below: 10% sales are cash, 50% of the credit sales are collected next month and the balance in the given month.

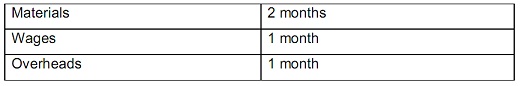

b) For the given items of expenditure, the credit terms are as shown below:

c) Cash and bank balance on 1st April 2010 is expected to be Rs 6 000.

d) Other relevant information:

i) Plant and Machinery will be installed in February 2010 at a cost of Rs 96 000. The monthly installments of Rs 2 000 is payable as from April onwards,

ii) A dividend of 5% on the ordinary share capital of Rs 200 000 will be paid on 1st June.

iii) An advance receipt of Rs 9 000 is expected in June and will associate to the sale of vehicles.

iv) Dividends from investments amounting to Rs 1 000 are to be received in May.

v) An advance payment of income tax is to be paid in June of Rs 2 000.

Required:

Question 1: Make a cash budget for the three months ending 30 June 2010.

Question 2: In brief describe the advantages of a cash budget.