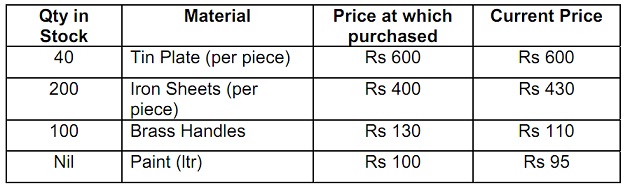

National Vending Ltd., manufactures and sells 4 varieties of vending machines. This year because of competition, its board of directors has decided to stop producing one particular variety – the milk vending machine. The available stocks of raw materials normally used for this machine can also be used for the other vending machines, and the stock position presently is as follows:

(Presently, the capacity utilization of the plant is 70% and at that level the company incurs Rs 280,000 as factory overhead and Rs 105,000 as administrative overhead).

The company just received an order for 100 such milk vending machines from an important customer and the board considered it worthwhile to supply this order more for liaison purposes, rather than for profit purposes. They looked at the cost structure of the milk vending machine as it was during the last year. Each machine required one tin plate, two iron sheets, one brass handle and five litres of paint. The labour cost worked out Rs 3,110. Special tools required for the manufacture of these machines are still with the company and are worth Rs 22,000. It is also estimated that if this order is undertaken, the factory overhead will go up to Rs 370,000 and the administrative overhead will go up to Rs 130,000.

Required:

The board wants to send you for negotiations with the customer and they want you to first tell them what will be the basic minimum price so that the company won’t incur any loss on this order.

Your answer should include the main principles of relevant cost and revenue determination?