Assignment - Capital Budgeting, Breakeven Analysis and Sensitivity Analysis

The Proposal:

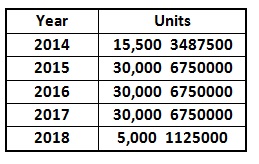

The Research and Development Division of your company has just developed a new gaming system termed as the Zed Box. The R&D Division spent $800,000 developing this product and the Marketing Division has spent the other $210,000 to assess the market demand. They believe that the Zed Box system has superior graphics and speed, and will have great market appeal at a competitive price of $225. The Marketing Division estimates the given demand for the Zed Box:

After that time they believe there would be no more sales of the product as newer products become available. The Zed Box is expected to cost $132 each to manufacture (variable cost). In addition, fixed production costs are estimated at $1 million per year. The manufacturing equipment essential to generate the games costs $2,800,000 million to buy and would be depreciated at a 30 percent CCA rate. The manufacturing equipment is expected to have salvage value equivalent to 15% of the initial cost. We would require investing $350,000 in net working capital up front (primarily for inventory) and NWC will rise to 18% of sales. The NWC will be recovered at the end of the project. The required return is 10%, and the tax rate is expected to be 42 %.

Requirements:

1) Using an Excel spreadsheet:

• Find out the NPV and the IRR of the Zed Box project by using the pro forma financial statement method to find out cash flows.

• Enter the input variables in cells of their own at the top of the spreadsheet (so it is simpler to do sensitivity computations).

• Set up the essential equations by referencing to the input variable cells. The spreadsheet should be formula driven; don’t put any numbers in equations, only cell references.

• Use Excel’s built-in functions wherever possible (example: PV and IRR functions).

2) Breakeven analysis (cash B/E point only)

Set up a formula in Excel (this formula is not built-in) to compute the cash breakeven point for the base case.

3) Sensitivity analysis:

a) Recognize all the variables used in the proposal that are estimates or are subject to change during the life of the project. In brief describe why such variables might change.

b) Select two variables which you identified above on which to do sensitivity analysis:

• Change such two variables (one at a time) in small increments via a fairly broad range of values by using your Excel spreadsheet, and show how sensitive the project is to changes in these two variables. Keep in mind, the better your sensitivity analysis, the more information it will give you to interpret and develop your recommendation.

• Present your sensitivity analysis in two Excel tables which summarize the results of your sensitivity analysis (that is, the NPV, IRR and Breakeven Analysis results at the different values for the input variables). You will require Copy/Paste Special/Value to paste the changed values into your tables. Or else the values in your tables will keep modifying when you change the input variables.