Problem1. Explain the three different types of decision models.

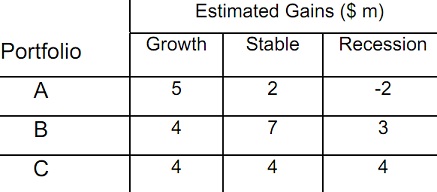

Problem2. An investment trust manager wishes to buy a portfolio of shares and he has sufficient funds to buy either portfolio A, portfolio B or portfolio C. The potential gains from his investment will depend upon the economy over the next 5 years and the following estimates have been made:

(a) Which strategy should be selected if the manager applies?

(i) The maximax criterion?

(ii) The maximin criterion?

(iii) The equal likelihood criterion?

(b) If the manager is realist and believes that the correct decision technique to determine the best alternative is to use a coefficient of realism of 0.75, calculate his criterion of realism.

(c) The manager estimates that the probability that the economy will grow over time is 0.5, while the probability of a recession is estimated at 0.2. Calculate the best decision using the expected monetary value criterion.

(d) Calculate the expected opportunity loss for each decision, and hence determine the optimal decision.

(e) A leading consulting firm is prepared to give more accurate estimates for the probabilities for a fee $250 000. Would it be worthwhile outsourcing?