You have to answer ALL the questions on this paper.

Problem 1:

(a) (i) The following table shows the hourly production schedule at Yuen Stickers, Inc., a poster manufacturer. Plant and machinery costs are $100, and the hourly wage per worker is $15. Fill in the blanks to complete the table, rounding your answers to 2 decimal places.

|

Number of Workers

|

Output

|

Total variable cost (TVC)

|

Total fixed cost (TFC)

|

Total cost

|

Average fixed cost (AFC)

|

Average variable cost (AVC)

|

Average total cost (ATC)

|

Marginal cost (MC)

|

|

|

|

(TC)

|

|

0

|

0

|

-

|

|

|

-

|

-

|

-

|

-

|

|

1

|

60

|

|

|

|

|

|

|

|

|

2

|

150

|

|

|

|

|

|

|

|

|

3

|

260

|

|

|

|

|

|

|

|

|

4

|

380

|

|

|

|

|

|

|

|

|

5

|

490

|

|

|

|

|

|

|

|

|

6

|

570

|

|

|

|

|

|

|

|

|

7

|

610

|

|

|

|

|

|

|

|

|

8

|

630

|

|

|

|

|

|

|

|

|

9

|

635

|

|

|

|

|

|

|

|

(ii) Describe the relationship between ATC and MC as indicated in the above table. [Hint: The relationship between ATC and MC refers to whether MC is below or above ATC to the left or right of the minimum point of the ATC curve].

(b) Use your knowledge learned in AF3625 Engineering Economics to answer the following questions. State the relevant concepts.

(i) A local club in District A charges a fixed monthly membership fee of $48. Members are allowed to borrow as many videos as they would like to under this membership plan. Suppose an average member borrows 8 videos per month. Now the local club decides to waive the monthly membership fee but charges $6 for borrowing each video. Discuss the effect of the new policy on the total number of videos lent out from the local club each month. Provide brief explanation to your answer.

(ii) "Without any government regulation, a single-price monopolist will always charge its consumers the highest affordable price they are willing to pay." Justify whether the statement is true or false. Explain your answer.

(iii) One of your classmates is reading the self-study notes for preparing for AF3625 examination and she makes the following statement: "Instead of reading the self-study notes for two hours, I could have gone shopping or watched a TV program. Therefore, the opportunity cost of reading the self-study notes is the shopping and the TV program that I have to give up." Justify whether the statement made by your classmate is correct or not. Explain your answer.

Problem 2:

(a) Consider a monopoly market with the following demand equation for a good Z.

P = 100 - 0.2 Q

Suppose fixed cost is zero and marginal cost is given by MC = 20.

Answer the following questions.

(i) Based on the information given, draw the diagram which shows the marginal revenue (MR) curve, marginal cost (MC) curve and the demand (D) curve of the monopoly. Show the value of X and Y intercepts for these curves.

(ii) Explain why the monopoly will not produce along the lower half of the demand curve.

(iii) Calculate the profit-maximizing price (PM) and quantity (QM) of the monopoly in the market. Show PM and QM in the diagram in part (i) and show your calculations.

(iv) Calculate the profit earned by the profit-maximizing monopoly. Show your calculation.

(v) Calculate the consumer surplus (CS) and producer surplus (PS) of the monopoly and the resulting deadweight loss (DWL). Show CS, PS, and DWL in your diagram in part (i).

(vi) Calculate the market equilibrium (i.e. PPC and QPC) that maximizes social surplus. Calculate producer surplus (PS) and consumer surplus (CS) for this case. Show your calculations.

Problem 3:

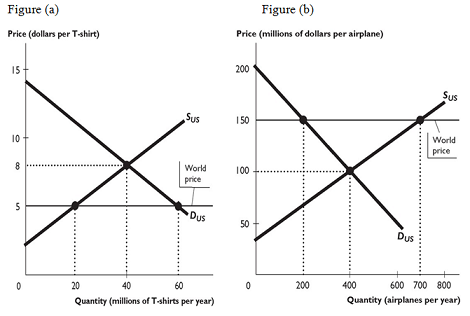

Figure (a) above shows the U.S. market for T-shirts, where SUS is the domestic supply curve and DUS is the domestic demand curve. The U.S. trades freely with the rest of the world. The world price of a T-shirt is $5.

Figure (b) above shows the U.S. market for airplanes, where SUS is the domestic supply curve and DUS is the domestic demand curve. The U.S. trades freely with the rest of the world. The world price of an airplane is $150 million.

(a) Based on figure (a), answer the following questions.

(i) U.S. should import / export (circle the answer) T-shirts and the export/import quantity is _______ millions of T-shirts per year at $ ________ per T-shirt.

(ii) As a result of international trade, consumer surplus increases / decreases / remains unchanged (circle the answer) by $_________ million. And producer surplus increases / decreases/ remains unchanged (circle the answer) by $_________ million.

(iii) International trade leads to a net gain / net loss (circle the answer) of surplus of $________million.

(iv) Label the consumer surplus and producer surplus before and after trade in figure (a). Label also the net gain / net loss of surplus after trade.

(b) Based on figure (b), answer the following questions.

(i) U.S. should import / export (circle the answer) airplanes and the export/import quantity is _________ airplanes per year at $_____ per airplane.

(ii) As a result of international trade, U.S. domestic production increases / decreases (circle the answer) by ________ airplanes.

(iii) As a result of international trade, consumer surplus increases / decreases / remains unchanged (circle the answer) by $_________ million. And producer surplus increases / decreases/ remains unchanged (circle the answer) by $_________ million.

(iv) International trade leads to a net gain / net loss (circle the answer) of surplus of $________billion.

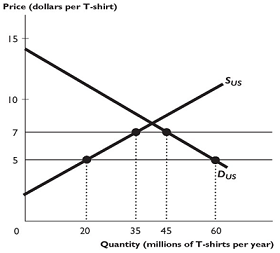

(c) Suppose a $2 per unit tariff is imposed on imported T-shirts as shown in the above figure.

(i) As a result of the tariff, consumer surplus in the U.S. increases / decreases (circle the answer) by $________million per year. Producer surplus in the U.S. increases / decreases (circle the answer) by $________million per year.

(ii) Government revenue from the tariff is $________ million per year.

(iii) Deadweight loss from the tariff is $________ million per year.

(iv) The U.S. net gain / loss (circle the answer) from the tariff is $________ million per year.

For Questions 4 and 5, please round up all the final answers to 2 decimal places. No marks will be awarded to the cash flow diagrams. You need to show the calculations for your answers.

Problem 4:

(a) (i) Suppose Danny Corporation issued a corporate bond four years ago at a par value (or face value) of $20,000 for a period of 10 years. The coupon rate is 10% for every 6 months until the maturity of the bond. If an investor is interested to purchase this bond now, what will be the maximum amount he/she is willing to pay for it if the market interest rate (i.e. the best alternative rate of return the investor can get) is 8% per year?

(ii) Most bonds pay a fixed coupon interest rate. Explain what would happen to people's demand for bonds and the price of the bonds under the following two situations: (1) when market interest rate falls and (2) when market interest rate rises.

(b) (i) The followings show two machinery options.

OPTION 1: The initial purchase price of the machine is $30,000. The salvage value at the end of the useful life will be $4,000. Maintenance costs are $2,000 for the first year and are estimated to increase by $200 per year.

OPTION 2: The machine is leased for an initial payment of $2,000 plus annual payments of $3,500. There is no salvage value. Annual maintenance cost is $10,000.

Put down the present value of each of the items specified for each machinery option in the table below. Assume an interest rate of 6% and a useful lifetime of 8 years. Show your calculations in the spaces below the table.

|

Present Value (PV) of Item

|

|

|

Option 1

|

Option 2

|

|

PV of Purchase/Lease

|

|

|

|

PV of Salvage Value

|

|

|

|

PV of Maintenance

|

|

|

|

Total PV

|

|

|

Option 1: Show calculations of PV of Salvage Value and PV of Maintenance.

Option 2: Show calculation of PV of Lease.

(ii) What is the annual equivalent cost of capital (i.e. capital recovery), over the 8-year lifetime, for the machine with the lowest present value calculated in the above table?

(c) (i) What is the amount of money that you should invest now if you want to receive payments of $1,000 at the end of each year for ten years with the receipt of the first payment starting three years from now? Assume interest rate is 5% compounded annually.

(ii) Provide explanation on your calculation in part c(i). Include in your explanation the specific type of cash flow given and the reason of why you have to derive the present or future equivalent value at various time points.

Problem 5:

(a) An economics school has just completed a new office building worth $500,000,000. A campaign has been set up to raise funds for future maintenance costs, which are estimated to be $2,000,000 per year. Assume that the school can create a trust fund that earns 8% interest annually.

(i) Determine how much needs to be put in the trust fund now to cover the infinite periods of $2,000,000 annual costs.

(ii) Now suppose an extra renovation cost of $100,000,000 would be incurred every 15 years besides the maintenance costs. Determine the total amount that has to be put in the trust fund now.

(iii) Provide another method to calculate the amount for extra renovation cost mentioned in part (ii) that is required to put in the trust fund now. The two methods used should produce the same answers. Any difference should be due to rounding error.

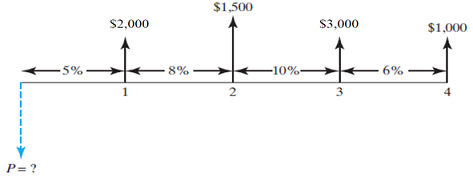

(b) Given the information in the following cash flow diagram, derive the present equivalent (P) of the cash flow series which have varying interest rates.

(c) Use another way to derive your answer for part (b). The answers for parts (b) and (c) should be the same. Any difference should be due to rounding error.

Leave all your assignment dilemmas to our Engineering Economics Assignment Help service and feel relax. We are offering the most excellent online service, which will definitely impress your university professor and they will surely give you top-notch grades.

Tags: Engineering Economics Assignment Help, Engineering Economics Homework Help, Engineering Economics Coursework, Engineering Economics Solved Assignments, Monopoly Market Assignment Help, Monopoly Market Homework Help, Profit-Maximizing Price Assignment Help, Profit-Maximizing Price Homework Help, Consumer Surplus and Producer Surplus Assignment Help, Consumer Surplus and Producer Surplus Homework Help, Market Equilibrium Assignment Help, Market Equilibrium Homework Help