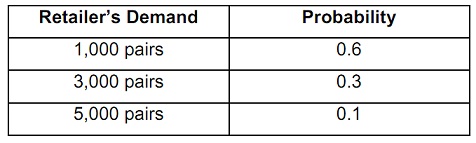

Question 1: A wholesaler of sports goods has an opportunity to buy 5,000 pairs of gloves which have been declared excess by the government. The wholesaler will pay Rs. 50 per pair and can get Rs. 100 a pair by selling gloves to retailers. The price is well established; however the wholesaler is in doubt about as to just how many pairs he will able to sell. Any gloves leftover, he can sell to discount outlets at Rs. 20 a pair. After a careful consideration of the past data, the wholesaler assigns probabilities to the demand as shown:

a) Calculate the conditional monetary and expected monetary values.

b) Calculate the Expected Monetary Value.

c) Calculate the Expected Opportunity Loss.

d) Calculate the expected profit with a perfect predicting device.

e) Calculate the Expected Value of Perfect Information.

Question 2: A businessman consists of two independent investments A and B available to him however he lacks the capital to undertake both of them simultaneously. He can select to take A first and then stop, or if A is successful then take B, or vice-versa. The probability of success on A is 0.7, while on B it is 0.4. Both investments need an initial capital outlay of Rs. 2,000, and both return nothing if the venture is unsuccessful. Successful completion of A will return Rs 3,000 (over cost) and successful completion of B will return Rs. 5,000 (over cost).

Draw and assess the decision tree by the roll back technique and find out the best strategy.

Question 3: The given is a pay-off matrix for a two person game.

a) Reduce the above pay-off matrix into a 2 x 2 matrix by using dominance property.

b) Solve the 2 x 2 matrix obtained from (a) by using mixed strategy.