Question 1: You have an option to purchase all of the assets of the Overland Railroad for $2.5 billion. The option expires in nine months. You estimate Overland's current (month 0) present value (PV) as $2.7 billion. Overland generates after-tax free cash flow (FCF) of $50 million at the end of each quarter (i.e., at the end of each three-month period). If you exercise your option at the start of the quarter, that quarter's cash flow is paid out to you. If you do not exercise, the cash flow goes to Overland's current owners. In each quarter, Overland's PV either increases by 10% or decreases by 9.09%. This PV includes the quarterly FCF of $50 million. After the $50 million is paid out, PV drops by $50 million. The risk-free interest rate is 2% per quarter.

A: Build a binomial tree for Overland, with one up or down change for each three-month period (three steps to cover your nine-month option).

B: Suppose you can only exercise your option now, or after nine months (not at month 3 or 6). would you exercise now?

C: Suppose you can exercise now, or at month 3, 6, or 9. What is your option worth today? Should you exercise today, or wait?

Question 2: Suppose that a bond pays a cash flow Ci at time Ti for i = 1, ....,N. Then the net present value (NPV) of cash flow Ci is

NPVi = Ciexp(-TiyTi).

Define the weights

wi = NPVi/Σj=1N NPVj

and define the duration of the bond to be

DUR = Σi=1 N wiTi,

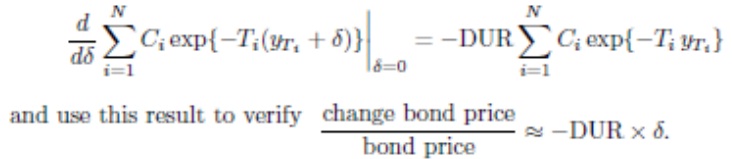

Which is the weighted average of the of the cash flows. Show that

Question 3: Modern Artifacts can produce keepsskes that will be sold for $60 each. Non-depreciation fixed costs are $2,600 per year, and variable costs are $30 per unit. The initial investment of $5,000 will be depreciated straight-line over its useful life of 5 years to a final value of zero, and the discount rate is 10%.

A. What is the accounting break-even level of sales if the firm pays no taxes?

B: What is the NPV break-even level sales if the firm pays no taxes?

C. What is the accounting break-even level of sales if the firm's tax rate is 40%?

D. What is the NPV break-even level of sales if the firm's tax rate is 40%?

Question 4: Consider a constant payment mortgage of $100,000, maturity 30 years, interest rate 6%, monthly payments. What is the yield of the mortgage if

(a) No point, no prepayment

(b) No point, prepaid after 10 years?

(c) 1 point and no prepayment

(d) 1 point, prepaid after 10 years, no prepayment penalty

(e) 1 point, prepaid after 10 years, 2% of prepayment penalty

Question 5: Greta, an elderly investor, has a degree of risk aversion of A = 4 wren applied to return on wealth over a 3-year horizon. She is pondering two portfoliQs., the S&P 500 and a hedge fund, as well as a number of 3-year strategies. (All rates are annual, continuously compounded.) The S&P 500 risk premium is estimated at 5% per year, with a SD of 17%. The hedge fund risk premium is estimated at 9% with a SD of 34%. The return on each of these portfolios in any year is uncorrelate a with its return or the return of any other portfolio in any other year. The hedge fund management claims the correlation coefficient between the annual returns on the

S&P 500 and the hedge fund in the same year is zero, but Greta believes this is far from certain.

A: Assuming the correlation between the anual returns on the two portfolios is index zero, what would be the optimal asset allocation?

B: What is the expected return on the portfolio?

C: What should be Greta's capital allocation?

Question 6: A pension fund manager is considering three mutual funds. Theis is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.2%. The probability distributions of the risky funds are

Return Standard Deviation

Assets 1 Stock Fund 13% 42%

Assets 2 Bond Fund 6% 36%

The correlation between the funds is 0.0222. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL.

A: What is the standard deviation of your portfolio?

B: What is the proportion invested in the T-bill bond and each of the two risk funds.

Question 7: A flood control project that will have a first cost of $250,000 and will require expansion at the end of ten years is being planned. The expansion will cost $55,000. the total project will be rehabilitated and overhauled 15 years after the expansion (at year 25) and at 15-year intervals thereafter. Each rehabilitation and overhaul will cost $25,000. The construction company that builds the project will maintain it for an annual fee of $8,000 until the expansion it accomplished. Thereafter, the flood control district will provide operating maintenance. Operating maintenance will cost $5,000 for the first year after expansion or rehabilitation and overhaul and will increase by $1,500 each year until the project is rehabilitated and overhauled, then the operating maintenance cost schedule is repeatet forever. Calculate the capitalized cost for the flood control project using an interest rate of 9%.

Question 8: Barack has just arranged to purchase a $550,000 retirement home in Hawaii with a 20 percent down payment. The mortgage has a 6.1 percent stated annual interest rate, compounded monthly, and calls for equal monthly payments over the next 30 years. His first payment will be due one month from now. However, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of Year 8. There were no other transaction costs or finance charges. How much will Barack's balloon payment be in eight years?

Question 9: The world's largest carpet maker has just completed a feasibility study of what to do with the 16,000 tons of overruns, rejects, and remnants it produces every year. The company's CEO launched the feasibility study by asking, why pay someone to dig coal out of the ground and then pay someone else to put our waste into a landfill? Why not just burn our own waste? The company is proposing to build a $10-million power plant to burn its waste as fuel, thereby saving $2.8 million a year in coal purchases. Company engineers have determined that the waste burning plant will be environmentally sound, and after its four-year study period the plant can be sold to a local electric utility for $5 million.

a. What is the IRR of this proposed power plant? (Please first use the interpolation method and then use the IRR function in Excel to check your answer. Attach your spreadsheet as part of the solution. As always, your Excel table should show the equations and cell referencing for your calculation).

Question 10: Consider a project to supply 100 million postage stamps per year to the U.S. Postal Service for the next five years. You have an idle parcel of land available that cost $850,000 five years ago; if the land were sold today, it would net you $1.080,000 aftertax. The land can be sold for S1,150.000 after taxes in five years. You will need to install S4.6 million in new manufacturing plant and equipment to actually produce the stamps; this plant and equipment will he depreciated straight-line to zero over the project's five years. 'the equipment can be sold for 5400.0(1) at the end of the project. You will also need $600,000 in initial net working capital for the project, and an additional investment of S50,000 in every year thereafter. You production costs are 0.45 cents per stamp, and you have fixed costs of S1.200,000 per year. If your tax rate is 34 percent and your required return on this project is 12 percent. what hid price should you submit on ihe contract?

Bid price = 3.55 cents per stamp

Question 11:

A person was considering buying a house priced at $320,000. A mortgage company claimed the interest rate for the 20-year loan is 3.375%. The company also estimated that the points and Appraisal. Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $11.000 in total. a) What would be the monthly payment, if the person decided to borrow 80% of the cost of the house and 100% of the processing fees? b) What is the APR of the loan? c) If the person accepts the terms of the loan on Feb. 28, 2010, the first monthly payment is due on March 31. How much mortgage would be paid off after the payment on August 31, 2016? d) How much interest charge could this person claim for deduction in the 2015 Tax Return, i.e. the total interest occur during year 2015?

Question 12: You want to buy a machine with the present worth of QR 100,000. You were able to finance it through a contract. The bank has set its monthly rate of return a 1.5% to be paid over 7 years. The first payment (to be paid at end of the first year) is QR 10,000. At the end of each subsequent year, the pa t changes according to a geometric gradient according to a certain percentage. Find the percientage fo&his metric gradient change (g) to cover the whole payment by the end of the 7th year.