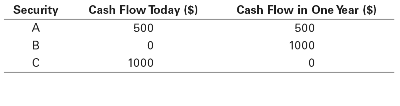

1.The promised cash flows of three securities are listed here. If the cash flows are risk-free, and the risk-free interest rate is 5%, determine the no-arbitrage price of each security before the first cash flow is paid.

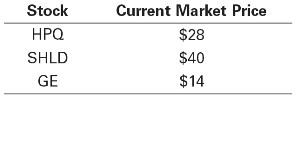

2.An Exchange-Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of Hewlett-Packard (HPQ), one share of Sears (SHLD), and three shares of General Electric (GE). Suppose the current stock prices of each individual stock are as shown here:

a. What is the price per share of the ETF in a normal market?

b. If the ETF currently trades for $120, what arbitrage opportunity is available? What trades would you make?

c. If the ETF currently trades for $150, what arbitrage opportunity is available? What trades would you make?