1.Suppose Pepsico’s stock has a beta of 0.57. If the risk-free rate is 3% and the expected return of the market portfolio is 8%, what is Pepsico’s equity cost of capital?

2.Suppose the market portfolio has an expected return of 10% and a volatility of 20%, while Microsoft’s stock has a volatility of 30%.

a. Given its higher volatility, should we expect Microsoft to have an equity cost of capital that is higher than 10%?

b. What would have to be true for Microsoft’s equity cost of capital to be equal to 10%?

3.Aluminum maker Alcoa has a beta of about 2.0, whereas Hormel Foods has a beta of 0.45. If the expected excess return of the marker portfolio is 5%, which of these firms has a higher equity cost of capital, and how much higher is it?

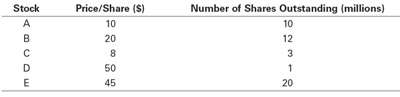

4.Suppose all possible investment opportunities in the world are limited to the five stocks listed in the table below. What does the market portfolio consist of (what are the portfolio weights)?

5.Using the data in Problem 4, suppose you are holding a market portfolio, and have invested $12,000 in Stock C.

a. How much have you invested in Stock A?

b. How many shares of Stock B do you hold?

c. If the price of Stock C suddenly drops to $4 per share, what trades would you need to make to maintain a market portfolio?