Attempt all the given questions:

Question 1: Define the term Accounting. Describe the given principles in detail.

a) Business Entity.

b) Consistency.

c) Matching.

d) Full disclosure.

Question 2:

a) What will be the result of the given on the Accounting Equation:

i) Purchased goods for Rs. 20,000 from Mahesh on credit.

ii) Sold goods to Suresh costing Rs. 8,000 for Rs. 10,000 in cash.

iii) Paid Wages Rs. 500.

iv) Withdrew in cash for private use Rs. 2,000.

v) Paid to Creditors Rs. 5,000.

b) Give the rule of Debit and Credit and elucidate them with imaginary illustrations.

Question 3:

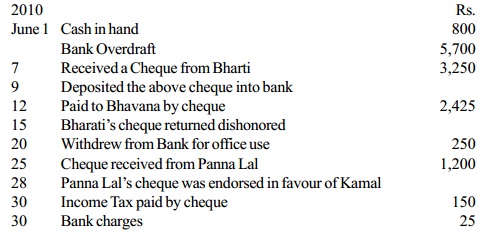

a) Enter the given transactions in the Cash Book with Cash and Bank Columns:

b) Describe the reasons on account of which the balance shown by the Pass Book doesn’t agree with the balance shown by the bank column of the Cash Book.

Question 4:

a) Trial Balance is not a conclusive proof of the accuracy of the books of accounts.

Describe this statement and explain the errors which are not disclosed in spite of the agreement of trial balance.

b) What are rectifying entries? How are two sided errors rectified?

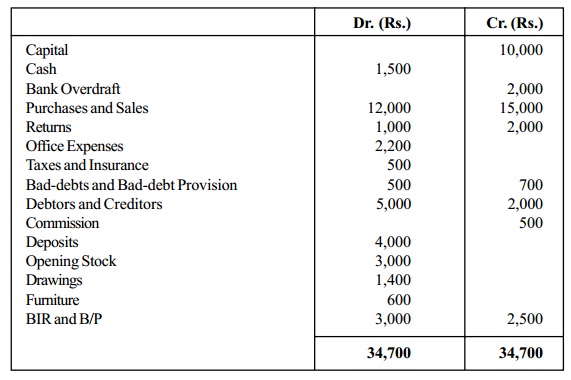

Question 5: Make Trading and Profit and Loss Account for the year ended 31st December, 2010 and Balance Sheet as on that date from the given Trial Balance:

Adjustments:

A) Salaries Rs. 100 and taxes Rs. 200 are outstanding but insurance Rs. 50 is prepaid.

B) Commission Rs. 100 is received in advance for next year.

C) Interest Rs. 210 is to be received on Deposits and Interest on Bank Rs. 300 is to be paid.

D) Bad-Debts provision is to be maintained at Rs. 1,000.

E) Depreciate furniture by 10%

F) Stock on 31-12-2010 was valued at Rs. 4,500.