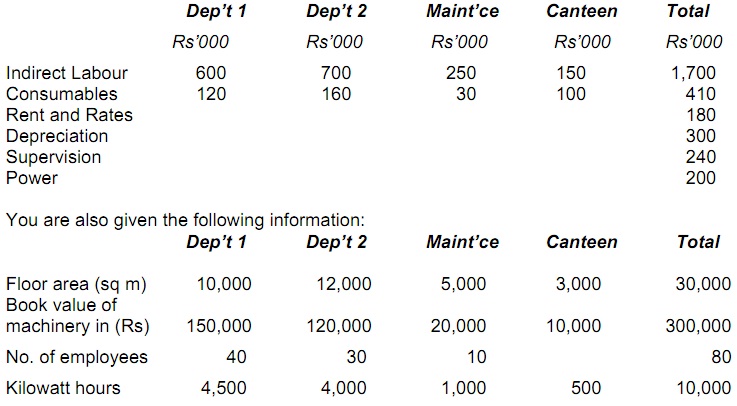

You are the Cost Accountant of a small resort in the north-west of the island and have been given the given budgeted information regarding four cost centers in your organization.

Further information:

a) Departments 1 and 2 are production centers and the maintenance department and canteen are service cost centers.

b) The maintenance department gives 3,200 service hours to Dep’t 1 and 4,800 service hours to Dep’t 2.

c) Department 1 is machine intensive and Department 2 is labor intensive.

d) 63,200 machine hours and 78,500 labor hours are budgeted for Dep’t 1 and 2 correspondingly.

Required:

a) An overhead cost statement showing the allocation and apportionment of overhead to the four cost centers, clearly showing the basis of apportionment.

b) Compute the overhead absorption rates for Department 1 and 2.

c) On the basis that actual overheads for Department 1 turn out to be Rs 1,500,000 and machine hours worked 60,000, compute the under or over recovery of overheads for each department. Analyze the value of under/over recovery of overheads and interpret your results.

e) What do you mean by activity-based-costing? How does it distinct from traditional product costing approaches?