Instructions:

Using the information provided, complete the following forms for Assignment Products, Inc., for the year ended December 31, 2015:

a. Form 1120, U.S. Corporation Income Tax Return

b. Form 1125-A, Cost of Goods Sold

c. Form 1125-E, Compensation of Officers

d. Form 8903, Domestic Production Activities Deduction

1. Assignment Products, Inc., 317 Careers Street, Arnold, MD 21012 is the corporation for which this return is to be completed. Assignment manufactures and sells peripheral devices for personal computers. It uses an accrual method of accounting and files its returns on a calendar year. Its EIN is 21-3456789. It was incorporated on May 1, 2002.

2. Paid Preparer information: Be sure to put your name here—it will identify your paper! Your PTIN: P00988888; Firm Name: Advanced Tax Accounting BPA 264, LLC; Address: 101 College Parkway, Arnold, MD 21012. Firm’s EIN: 52-8966698

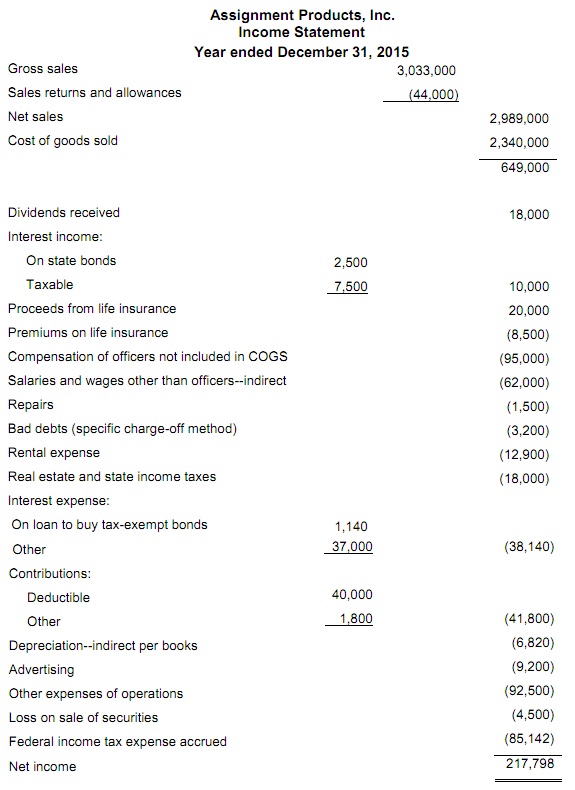

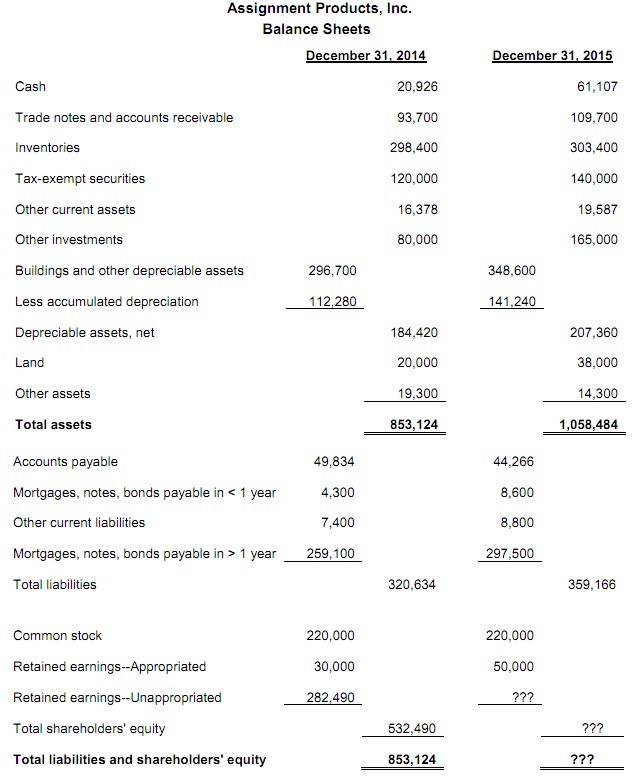

3. The income statement for the year ended December 31, 2015 is attached, as are the balance sheets for December 31, 2014 and December 31, 2015.

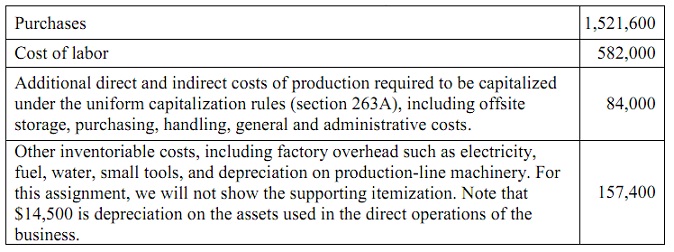

4. Additional information to complete Form 1125-A, Cost of Goods:

- Assignment used the lower of cost or market method to value closing inventory in 2014 and 2015.

- There was no writedown of subnormal goods.

- LIFO was not adopted or used this tax year.

- The rules of section 263A apply to this entity.

- There was no change in determining quantities, costs, or valuations between opening and closing inventory.

5. The dividends were received from TruTech Corporation, a domestic corporation. Assignment owns less than 1% of TruTech.

6. The interest income was from the following sources:

a. Investments in state bonds.

b. Interest earned on cash in bank and investment accounts, $4,000.

c. $3,500 interest on business receivables for which the company received no form 1099-INT.

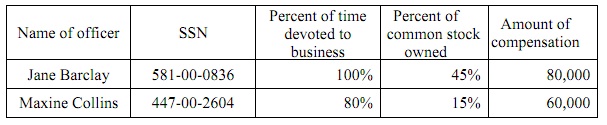

7. The officers and their compensation are as follows. $45,000 of the officers’ pay is included in the general and administrative costs used to calculate cost of goods sold.

8. Salaries and wages of $62,000 includes only salaries and wages neither included on line 12 nor deducted as part of cost of goods sold. This amount represents nonmanufacturing salaries and wages, such as office salaries.

9. Repairs include only payments for items that do not add to the value of the assets repaired or substantially increase their useful lives.

10. Assignment uses the specific charge-off method of accounting for bad debts, thus the company does not maintain an allowance for bad debts.

11. Rent for Assignment’s office facilities was $12,900 for the year.

12. Real property tax and state income tax accrued during 2015 total $18,000.

13. Interest expense accrued during the year totaled $38,140. This includes interest both on debts for business operations and debts to carry investments, as well as $1,140 interest to carry tax-exempt securities.

14. During the year, Assignment contributed $14,800 to the United Community Fund and $27,000 to the State University Scholarship Fund. The company received merchandise valued at $1,800 from State University. Watch out for the limit on deductions for charitable contributions.

15. Total depreciation from Form 4562 (this form is not required for this assignment) is $23,900. Of this, $13,700 is included in the amount claimed on line 5 of Form 1125-A. The remainder represents the depreciation on the assets used in the indirect operations of the business. Note that this amount is different from the amount shown in the financial statements, as tax rules for depreciation are different from those for financial accounting.

16. Advertising expense was $9,200.

17. Assignment does not have a pension or profit-sharing plan, nor does it have employee benefit programs. (Now there’s a simplifying assumption!)

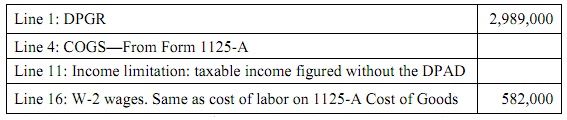

18. Calculate the domestic production activities deduction on Form 8903. Use the small business simplified overall method. Here’s the information you need:

19. Other business deductions total $92,500, including miscellaneous office expenses, sales commissions, legal fees, etc. For this assignment, you are not required to attach a schedule that itemizes these expenses.

20. The loss on sale of securities represents the excess of capital losses over capital gains for 2015. You are not required to prepare Schedule D or Form 8949 for this assignment.

Schedule J information:

21. The corporation is not a member of a controlled group nor is it a personal service corporation.

22. For this assignment, you are not required to calculate the alternative minimum tax; assume it’s zero.

23. Other taxes and credits listed on Schedule J do not apply to Assignment this year.

24. Assignment’s quarterly estimated payments for tax year 2015 were made at the required times and totaled $90,000. If the corporation has a refund due, it will apply the refund to 2016 estimated tax.

Schedule K information

25. Look up the business activity code in the instructions for Form 1120.

26. Answer all questions “no,” except questions 15a and 15b. The corporation did make payments that required issuing forms 1099, and it issued those forms as required.

27. The corporation had 10 shareholders at the end of the year.

Schedule L information

28. Balance Sheets per Books. Provide comparative balance sheets for the beginning and end of the tax year. Entries on this page should agree with amounts shown elsewhere on the return.

The balance sheets are provided with this assignment.

29. You will determine the ending balance for unappropriated retained earnings at December 31, 2015, by completing Schedule M-2.

Schedule M-1 information

30. You can identify the book to tax differences by comparing the information on the tax return with that on the income statement.

Schedule M-2 information

31. During 2015, Assignment had an IRS examination of its 2012 tax return. As a result of the examination, the company received a refund of $14,000. Using the accrual basis of accounting, this is not income for 2015, but we must include it in ending retained earnings.

The amount shown for retained earnings for December 31, 2014 does not include this amount, as it is the amount shown on the 2014 Form 1120, before the refund occurred.

32. During 2015, Assignment declared and paid dividends to shareholders of $65,000.

33. During 2015, Assignment appropriated $20,000 of retained earnings because of a contingent liability related to the outcome of a pending lawsuit.

Attachment:- Taxation.rar