Question 1: Anita Job owns 507 shares in the Rapid Employment Corp. (a firm that provides temporary work). There are II directors to be elected. Twenty-one thousand shares are outstanding. The firm has adopted cumulative voting.

a) How many total votes can be cast?

b) How many votes does Anita Job control?

c) What percentage of the total votes does she control?

Question 2: Silicon Industries has a cumulative preferred stock issue outstanding, which has a stated annual dividend of $8 per share. The company has been losing money and has not paid preferred dividends for the last four years. Them are 260,000 shares of preferred stock outstanding and 500,000 shares of common stock.

a. How much is the company behind in preferred dividends?

b. If Silicon Industries cams $7.5 million in the coming year after taxes and before dividends, and this is all paid out to the preferred stockholders, how much will the company be in arrears (behind in payments)? Keep in mind that the coming year would represent the fifth year.

c. How much, if any, would be available in common stock dividends in the coming year if $7.5 million is earned as explained in part b?

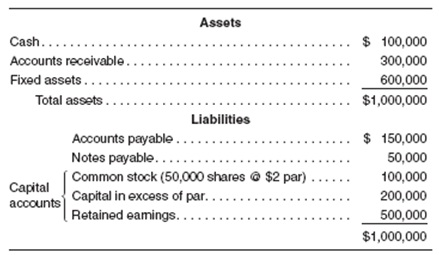

Question 3: Squash Delight, Inc., has the following balance sheet:

The firm's stock sells for $10 a share.

a. Show the effect on the capital account(s) of a two-for-one stock split.

b. Show the effect on the capital accounts of a 10 percent stock dividend. Part b is separate from part a. In part b do not assume the stock split has taken place.

c. Based on the balance in retained earnings, which of the two dividend plans is more restrictive on future cash dividends?

Question 4: The Vinson Corporation has earnings of $500,000 with 250.000 shares outstanding. Its P/E ratio is 20. The firm is holding $300,000 of funds to invest or pay out in dividends. If the funds are retained, the aftertax return on investment will be 15 percent. and this will add to present earnings. The 15 percent is the normal return anticipated for the corporation, and the P/E ratio would remain unchanged. If the funds are paid out in the form of dividends, the P/E ratio will increase by 10 percent because the stockholders in this corporation have a preference for dividends over retained earnings. Which plan will maximize the market value of the stock?

Question 5: The bonds of Goldman Sack Co. have a conversion premium of $55. Their conversion price is $40. The common stock price is $42. What is the price of the convertible bonds?