Assignment:

Answer the following questions:

1. During the holiday season, when the public’s holdings of currency increase, what defensive open market operations typically occur? Why?

2.Does the existence of deposit insurance eliminate the need for discount loans control for the effects of bank panics?

3. What are the disadvantages of using loans to financial institutions to prevent bank panics?

4. Would it be a good idea to raise reserve requirements to 100% to ensure bank stability and to completely control the money supply?

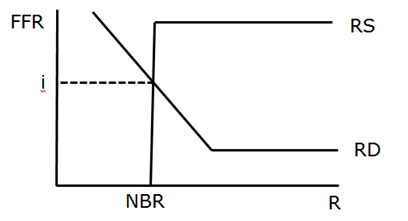

5.Using the following supply and demand diagram of the market for reserves, indicate what happens to the federal funds rate, borrowed reserves, and nonborrowed reserves, holding everything else constant, when a switch occurs from deposits into currency .

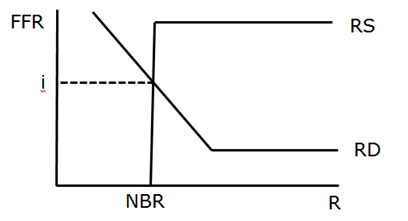

6.Using the following supply and demand diagram of the market for reserves, indicate what happens to the federal funds rate, borrowed reserves, and nonborrowed reserves, holding everything else constant, when the economy is surprisingly strong, leading to an increase in the amount of checkable deposits.