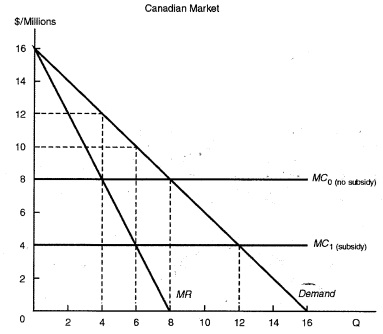

Assume Boeing Inc. (of the United States) and Airbus Industrie (of Europe) rival for monopoly profits in the Canadian aircraft market. Suppose the two firms face identical cost and demand conditions, as seen below.

1. Referring to attached graph, assume that Boeing is the first to enter the Canadian market. Without a governmental subsidy, the firm maximizes profits by selling _______ aircraft at a price of $__________, and realizes profits totaling $__________.

2. Considering the attached graph - Suppose the European government provides Airbus a subsidy of $4 million on each aircraft manufactured, and that the subsidy convinces Boeing to exit the Canadian market. As the monopoly seller, Airbus maximizes profit by selling _______ aircraft at a price of $__________, and realizes profits totaling $__________.

3. Considering the attached graph - For Europe as a whole (Airbus and European taxpayers), the subsidy leads to a (an) increase/decrease in net revenues of $__________.