Question 1: This problem requires you to use information from the 2011 financial statements of Ace Hardware Stores. To find those statements, go to https://ourcompany.acehardware.com/financialreports.asp and click on the link to “Financial Statements” under the item 2011 Annual Summary (dated April 19, 2012). This opens a pdf document. Pages 4 and 5 (of 36) of that document will have the information needed. Using that information, calculate the following (Be sure to show your work):

a) Current Ratio at the end of 2011

b) Debt-Equity Ratio at the end of 2011

c) Profit Margin for 2011

d) Rate of Return on Assets for 2011

Question 2: On January 1 a bond with face value of $1,000 is for sale in the market. That bond has a coupon rate of 6%, pays interest once a year and the end of the year, and matures at the end of 10 years. If the “market” interest rate on January 1 is 5%, what would you expect the selling price of that bond to be? (Be sure to show your work.)

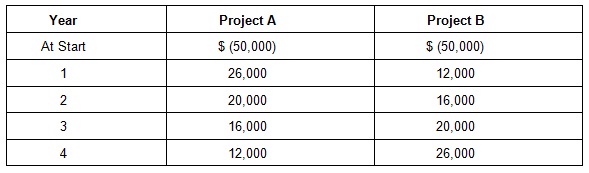

Question 3: Towson Enterprises has identified two mutually exclusive (can’t do both) projects. The relevant cash flows and timing of those cash flows are shown in the following table. Assume that the cash flows in years 1 through 4 all are received at the end of the year.

a) What is the approximate internal rate of return for each of the two projects? If you apply the internal rate of return decision rule, which project should Towson accept? (Be sure to show your work.)

b) If the required rate of return is 9%, what is the net present value for each of the two projects? Which project would Towson choose if it applies the net present value decision rule? (Be sure to show your work.)

Question 4: Brixton Products is considering the purchase of a new $520,000 computer-based entry order system. The cost of the system will be depreciated on a straight-line basis over its five-year life. Brixton plans to sell the applicable computer equipment at the end of five years for $40,000. During the five-year life of the project, Brixton will save $160,000 each year in order-processing costs. What is the approximate internal rate of return for this project? Ignore income taxes. (Be sure to show your work.)

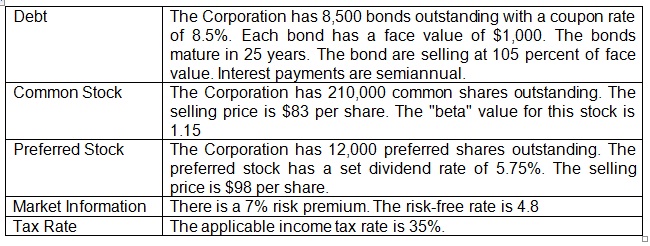

Question 5: Given the following information for Allyson Corporation, calculate the Corporation’s weighted cost of capital. (Be sure to show your work.)

Question 6: McGovern Company is comparing two different capital structures - an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the Company would have 700,000 shares of stock outstanding. Under Plan II, the Company would have 450,000 shares of stock outstanding and $6 million in debt outstanding. The interest rate on the debt would be 10%. Assume no taxes.

a) If earnings before interest is $1.3 million, which plan would result in the highest earnings-per-share? (Be sure to show your work.)

b) If earnings before interest is $2.8 million, which plan would result in the highest earnings-per-share? (Be sure to show your work.)