Opry Company

The management of Opry Company, a wholesale distributor of suntan products, is considering the purchase of a $40,000 machine that would reduce operating costs in its warehouse by $5,500 per year.

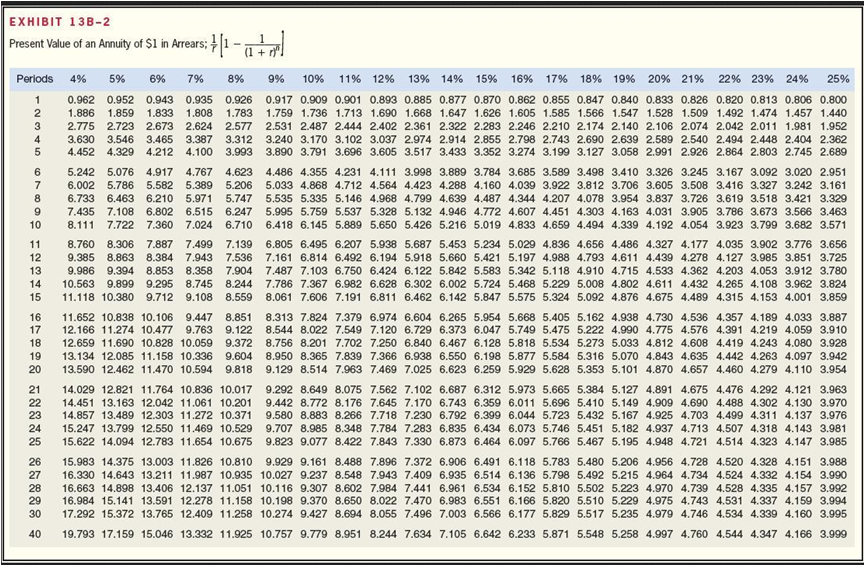

At the end of the machine's 10-year useful life, it will have no scrap value. The company's required rate of return is 9%. (Ignore income taxes.)

*Determine the appropriate discount factor(s) using table.

Required:

Determine the net present value of the investment in the machine. (Negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate and final answers to the nearest dollar amount.

What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?