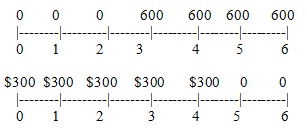

Question 1. Which of the following two annuities would you prefer to receive (based on sound financial reasoning) if the appropriate discount rate is 12 percent?

Question 2. The Virginia Medical Company is contemplating the replacement of one of its dialysis machines with a newer and more efficient one. The old machine has a book value of $300,000 and a remaining useful life of 3 years. The firm does not expect to realize any return from scrapping the old machine in 3 years, but it can sell it now to another firm in the industry for $150,000. The old machine is being depreciated toward a zero salvage value, or by $100,000 per year, using the straight-line method.

The new machine has a purchase price of $600,000, an estimated useful life and MACRS class life of 3 years, and an estimated salvage value of $75,000. It is expected to economize on power usage and repair costs, as well as to service more patients per day. In total, an annual increase in net revenues of $150,000 will be realized if the new machine is installed. An additional $20,000 in net working capital will be required during the period the new machine is in use. The company is in the 40 percent federal-plus-state tax bracket, and it has a 12 percent marginal cost of capital. (MACRS 3-year class depreciation percentages for years 1-4 are 33%, 45%, 15%, and 7%, respectively.

a. What is the initial net cash outflow required if the new machine is installed?

b. Compute the change in the annual depreciation expense if the replacement is made.

c. What are the periodic operating cash flows for each year of the project?

d. What is the end-of-project (terminal) cash flow?

e. What is the NPV of the project?