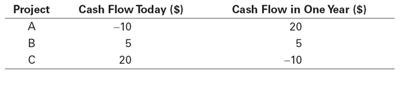

1.Your firm has identified three potential investment projects. The projects and their cash flows are shown here:

Suppose all cash flows are certain and the risk-free interest rate is 10%.

a. What is the NPV of each project?

b. If the firm can choose only one of these projects, which should it choose?

c. If the firm can choose any two of these projects, which should it choose?

2.Your computer manufacturing firm must purchase 10,000 keyboards from a supplier. One supplier demands a payment of $100,000 today plus $10 per keyboard payable in one year. Another supplier will charge $21 per keyboard, also payable in one year. The risk-free interest rate is 6%.

a. What is the difference in their offers in terms of dollars today? Which offer should your firm take?

b. Suppose your firm does not want to spend cash today. How can it take the first offer and not spend $100,000 of its own cash today?