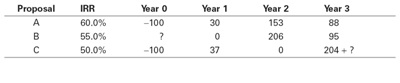

1.You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm’s manufacturing facility. You find that the prior analysis ranked the proposals according to their IRR, and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this recommendation was appropriate. But while you are confident the IRRs were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in year 0. And for Proposal C, you cannot find the data regarding additional salvage value that will be recovered in year 3. Here is the information you have:

Suppose the appropriate cost of capital for each alternative is 10%. Using this information,determine the NPV of each project. Which project should the firm choose?

Why is ranking the projects by their IRR not valid in this situation?

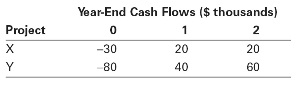

2.You are evaluating the following two projects:

Use the incremental IRR to determine the range of discount rates for which each project is optimal to undertake. Note that you should also include the range in which it does not make sense to take either project.

3.Consider two investment projects, which both require an upfront investment of $10 million, and both of which pay a constant positive amount each year for the next 10 years. Under what conditions can you rank these projects by comparing their IRRs?

4.You are considering a safe investment opportunity that requires a $1000 investment today, and will pay $500 two years from now and another $750 five years from now.

a. What is the IRR of this investment?

b. If you are choosing between this investment and putting your money in a safe bank account that pays an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR with the IRR of the investment? Explain.