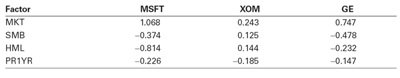

For Problems 1–3, refer to the following table of estimated factor betas.

1.Using the factor beta estimates in the table shown here and the expected return estimates in Table 13.1, calculate the risk premium of General Electric stock (ticker: GE) using the FFC factor specification.

2.You are currently considering an investment in a project in the energy sector. The investment has the same riskiness as Exxon Mobil stock (ticker: XOM). Using the data in Table 13.1 and the table above, calculate the cost of capital using the FFC factor specification if the current risk-free rate is 6% per year.

3.You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company. Using the data in Table above, calculate the cost of capital using the FFC factor specification if the current risk-free rate is 5.5% per year.