Assignment:

1. Why do you think that U.S. banks are prohibited from holding equity as part of their own portfolios?

2. Banks hold more liquid assets than do most businesses. Explain why.

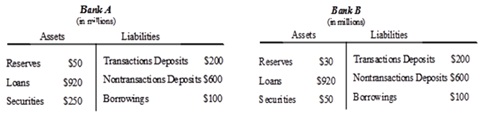

3. Consider the balance sheets of Bank A and Bank B. If reserve requirements were 10 percent of transaction deposits and both banks had equal access to the interbank market and funds from the Federal Reserve, which bank do you think faces the greatest liquidity risk? Explain your answer.

4. Suppose you are advising a bank on the management of its balance sheet. In light of the financial crisis of 2007-2009, what arguments might you make to convince the bank to hold additional capital?

[Note: the bank's capital = its assets - liabilities]

5. Read the following article "Why Climate Change Matters for Monetary Policy and Financial Stability."

a) Do you agree or disagree with Fed Governor Lael Brainard's assessment on climate change and monetary policy?

b) Do you think a bank or other financial institutions should be concerned with climate change? How would climate change affect how banks conduct business with its clients?

c) How does climate change fit into the works of the Federal Reserve? Its primary goals is to regulate the money supply. How does that fit into the argument that money can affect climate change?

Your essay should be a minimum of 200 words.