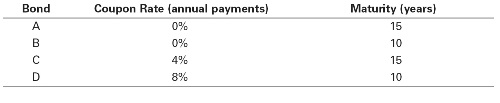

1.Consider the following bonds:

a. What is the percentage change in the price of each bond if its yield to maturity falls from 6% to 5%?

b. Which of the bonds A–D is most sensitive to a 1% drop in interest rates from 6% to 5% and why? Which bond is least sensitive? Provide an intuitive explanation for your answer.

2.Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 6%. You hold the bond for five years before selling it.

a. If the bond’s yield to maturity is 6% when you sell it, what is the internal rate of return of your investment?

b. If the bond’s yield to maturity is 7% when you sell it, what is the internal rate of return of your investment?

c. If the bond’s yield to maturity is 5% when you sell it, what is the internal rate of return of your investment?

d. Even if a bond has no chance of default, is your investment risk free if you plan to sell it before it matures? Explain.