1.Explain why the expected return of a corporate bond does not equal its yield to maturity.

2.Grummon Corporation has issued zero-coupon corporate bonds with a five-year maturity. Investors believe there is a 20% chance that Grummon will default on these bonds. If Grummon does default, investors expect to receive only 50 cents per dollar they are owed. If investors require a 6% expected return on their investment in these bonds, what will be the price and yield to maturity on these bonds?

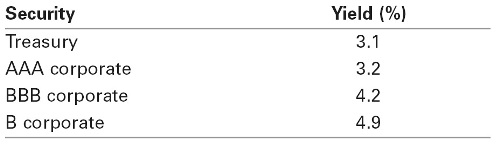

3.The following table summarizes the yields to maturity on several one-year, zero-coupon securities:

a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating?

b. What is the credit spread on AAA-rated corporate bonds?

c. What is the credit spread on B-rated corporate bonds?

d. How does the credit spread change with the bond rating? Why?

3.Andrew Industries is contemplating issuing a 30-year bond with a coupon rate of 7% (annual coupon payments) and a face value of $1000. Andrew believes it can get a rating of A from Standard and Poor’s. However, due to recent financial difficulties at the company, Standard and Poor’s is warning that it may downgrade Andrew Industries bonds to BBB. Yields on A-rated,long-term bonds are currently 6.5%, and yields on BBB-rated bonds are 6.9%.

a. What is the price of the bond if Andrew maintains the A rating for the bond issue?

b. What will the price of the bond be if it is downgraded?