Questions

1. (a) In terms of the land acquisition for stage 1, what cost, if any, should be attributed to the rainbow trout project? Why?

(b) (i) If the currently owned site is used for this project, what should Kereru Fisheries Ltd do about its land needs for stage 2? [Hint: Calculate the present value of purchasing the option now and compare it with the present value of purchasing the land outright later on. Which is the better alternative? Why?]

(ii) What discount rate would you use in analysing the option alternative? Why?

2. (a) (i) If the stage 1 project is not undertaken, how should you treat the R&D expenses? Calculate the tax savings in 2012.

(ii) If stage 1 is undertaken and the project goes ahead, how should you treat the R&D expenses?

(iii) Is there any opportunity cost if the firm undertakes the project?

If so, calculate the benefit lost as a result.

(b) Describe how salvage values are taxed. Use the building's salvage value to illustrate your answer.

3. Determine stage 1's net cash flow from 2012 to 2020 (t0 - t8). Assume that the stage 1 project is judged as average risk. What are its stand-alone NPV, IRR, MIRR, and payback? Give your answers to at least one decimal place.

4. Now consider the expansion (stage 2) project.

(a) What are its stand alone NPV, IRR, and MIRR as of December 31, 2018 (t = 6), under each demand scenario? Show the NPV for today (t

= 0).

(b) What is the expected NPV of stage 2, assuming there is an 80% probability that demand will be high during stage 2, but a 20% chance that demand will be low? Assume that stage 2 is an average-risk project. (Hint: Remember that acceptance of stage 2 requires the firm to forego the stage 1 net working capital recovery. This represents an opportunity cost to stage 2 that is not reflected in the cash flows shown previously.)

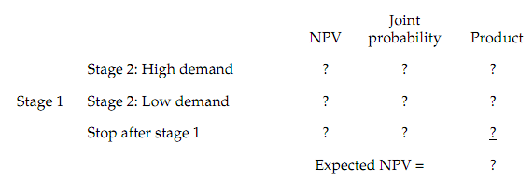

5. Kereru Fisheries Ltd estimates that there is a 90% chance that stage 1 will meet all expectations and, consequently, that stage 2 will be undertaken. What is the expected NPV of Kereru Fisheries Ltd's rainbow trout project? Using Table 3 as a guide, construct a decision tree to help in your analysis. (Hint: You need to fill in the figures where indicated.)

TABLE 3

Rainbow trout project decision tree.

6. Use your decision tree data to find the project's standard deviation and coefficient of variation of NPV. Suppose that Kereru Fisheries Ltd's average projects have coefficients of variation of NPV in the range of 0.5 to 1.0. Would this project be classified as a high-risk, average-risk, or low-risk project?

7. What is the overall project's risk-adjusted NPV? (Hint: Use the percentage given in the question to adjust up or down to obtain the risk-adjusted discount rate. Use this to re-calculate the NPV, IRR, MIRR, payback period, and expected NPV as for Question 4 and 5.)

8. Consider all of the information obtained so far. What do you think Kereru Fisheries Ltd should do? Carefully justify your final conclusions. (Hint: Discuss the viability of the two stage process in this project, the suitability of the risk-adjusted discount rate and the possibility of using real options, such as abandonment or a timing option.)