Assignment:

Overview:

After qualitative risk analysis of project risks, quantitative risk analysis is used for risk of high priority (either high threat or opportunity risks). This assignment focuses on some common quantitative risk analysis tools/ techniques.

Decision Tree Analysis is one of the tools and techniques of quantitative risk analysis.

Decision trees use Expected Monetary Value (EMV) which is another tool/ technique of quantitative risk analysis. Program Evaluation and Review Technique (PERT) is another tool which uses estimation to complete quantitative risk analysis.

Remember:

The Impact used in EMV is in days or dollars.

PERT is a particular type of 3-point estimation, where the Most Likely estimate is weighted 4 times the optimistic or pessimistic estimates. All 3 estimates are used to calculate PERT.

Below are exercises in both decision tree analysis and PERT estimation.

Instructions for Exercise 1 and Exercise 2:

Exercise 1

Scenario: You are the project manager on a project and you are developing the project schedule, this includes estimating the duration of activities for the project. You ask one of your team members how long it will take them to complete development of a feature in a web application. You want to provide the best numerical estimate possible so you employ the tool/ technique of PERT estimation.

Your team member provides the following estimates for this activity:

• Optimistic= 5 days

• Pessimistic= 20 days

• Most Likely= 12 days

Be sure to answer the following:

• What is the equation used for the PERT estimate?

• What is the PERT estimate for this activity?

Exercise 2:

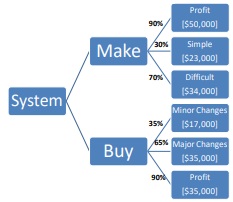

Given the following Decision Tree, perform decision tree analysis to determine which is best to do, make or buy a software application as part of a development project?

Remember that this requires the use of EMV.

The Simple and Difficult solutions of the Make decision have costs and losses associated with them, as shown in this diagram. The Buy decision also has costs associated with them. Note: The probabilities of the branches do not add up to 100%, as this is not required.

Be sure to answer the following:

• What is the equation for EMV?

• Should you make or buy the system?

Note: When calculating the EMV, please make sure profits are calculated as positive (+) values and losses are calculated as negative (-) values.

Requirements:

• APA format (references, if applicable)

• No page length required. Please show all of your work for both exercises, so it may be graded properly.