Assignment:

Objectives

The purpose of the Unit Exercises is to assess the student's ability to apply the economics concepts learned in the unit to practical problem-solving scenarios.

Instructions

Complete the questions below that are based on your chapter readings.

1. a. What is fiscal policy? What kind of fiscal policy is needed to reduce unemployment problem?

b. What is monetary policy? What kind of monetary policy is needed to fight inflation problem?

2. Write an essay on debt and deficit and include answers to the following in your essay:

- What is budget deficit and how is it related to Government debt?

- What is cyclical adjustment to deficit and how does it help to understand the stance of fiscal policy?

- What is crowding out? How does budget deficit crowd out investment?

- Why is a high level of government debt is a matter of concern?

Instructions

Complete the questions below that are based on your chapter readings.

1. Use the following assumptions for this question. The commercial banking system has a target reserve ratio of 5% and there is no cash drain. A new immigrant to the country makes a cash deposit of $1,000. In the following table show how deposits, reserves, and loans change as the new deposit permits the banks to "create" money.

|

Round

|

Δ Deposits

|

Δ Reserves

|

Δ Loans

|

|

First

|

|

|

|

|

Second

|

|

|

|

|

Third

|

|

|

|

|

Fourth

|

|

|

|

|

Fifth

|

|

|

|

a. Complete the entire table.

b. You have now completed the first five rounds of the deposit-creation process. What is the total change in deposits so far as a result of the single new deposit of $1000?

c. This deposit-creation process will go on forever, but it will have a finite sum. In the text, we showed that the eventual total change in deposits is equal to 1/v times the new deposit, where v is the target reserve ratio. What is the eventual total change in deposits in this case?

d. What is the eventual total change in reserves? What is the eventual change in loans?

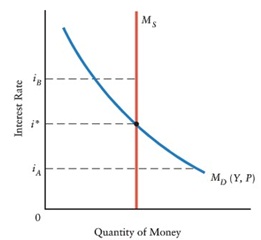

2. The diagram below shows the demand for money and the supply of money.

a. Explain why the Money Demand Curve is a downward sloping curve.

b. Suppose the interest rate is at iA. Explain how firms and households attempt to satisfy their excess demand for money. What is the effect of their actions?

c. Suppose the interest rate is at iB. Explain how firms and households attempt to dispose of their excess supply of money. What is the effect of their actions?

d. Now suppose there is an increase in the transactions demand for money because of growth in real GDP. Beginning at i*, explain what happens in the money market. How is this shown in the diagram?