PROBLEM 1

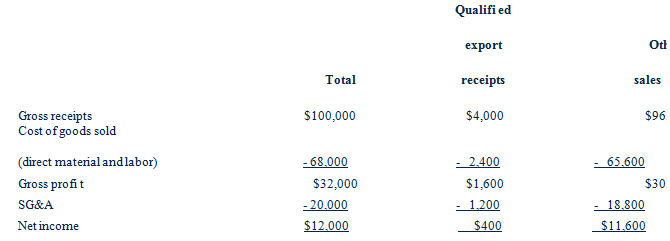

Acme, Inc., a domestic corporation, manufactures goods at its U.S. factory for sale in the United States and abroad. Acme has established an IC-DISC. During the current year, Acme's qualifi ed export receipts are $4,000, and the related cost of goods sold is $2,400. Acme has $1,200 of selling, general and administrative (SG&A) expenses related to the qualifi ed export receipts. Acme's gross receipts from domestic sales are $96,000, the related cost of goods sold is $65,600, and the related SG&A expenses are $18,800. In sum, Acme's results for the year (before considering any income allocated to its IC-DISC via a commission payment), are as follows:

What is the maximum amount of income that Acme can allocate to its IC-DISC? (Assume combined taxable income equals the $400 of net income from qualifi ed export receipts.)

PROBLEM 2

Finco is a wholly owned Finnish manufacturing subsidiary of Winco, a domestic corporation that manufactures and markets residential window products throughout the world. Winco has been Finco's sole shareholder since Finco was organized in 2000. At the end of the current year, Winco sells all of Finco's stock to an unrelated foreign buyer for $25 million. At that time, Finco had $6 million of post-1986 undistributed earnings, and $2 million of post-1986 foreign income taxes that have not yet been deemed paid by Winco. Winco's basis in Finco's stock was $5 million immediately prior to the sale.

Assume Winco's capital gain on the sale of Finco's stock is not subject to any foreign taxes, and that the U.S. corporate tax rate is 35%. What are the U.S. tax consequences of this sale for Winco?

Now assume that instead of selling the stock of Finco, Winco completely liquidates Finco, and receives property with a market value of $25 million in the transaction. As in the previous scenario, at the time of the liquidation, Finco had $6 million of accumulated earnings and profi ts, and $2 million of foreign income taxes that have not yet been deemed paid by Winco. Assume that Winco's basis in Finco's stock was $5 million immediately prior to the liquidation, and that the U.S. corporate tax rate is 35%. What are the U.S. tax consequences of this liquidation for Winco?