Assignment Part 1:

Question 1: Your firm has identified three potential investment projects. The projects and their cash flows are shown here (a negative value is a cash outflow and a positive value an inflow.)

|

Project

|

Cash FlowToday ($)

|

Cab Flow in One Year ($)

|

|

A

|

-10

|

20

|

|

B

|

5

|

5

|

|

C

|

20

|

-10

|

Suppose all cash flows are certain and the risk-free interest rate is 10%.

a. What is the NPV of each project?

b. If the firm can choose only one of these projects, which should it choose?

c. If the firm can choose any two of these projects, which should it choose?

Question 2: Xia Corporation is a company whose sole assets are $100,000 in cash and three projects that it will undertake. The projects are risk free and have the following cash flows:

|

Neat

|

Cash Row Today ($)

|

Cab Flow in One Year (a)

|

|

A

|

-20,000

|

30,000

|

|

B

|

-10,000

|

26,000

|

|

C

|

-60,000

|

80,000

|

Xia plans to invest any unused cash today at the risk-free interest rate of 10%. In one year, all cash will be paid to investors and the company will be shut down.

a. What is the NPV of each project? Which projects should Xia undertake and how much cash should it retain?

b. What is the total value of Xia's assets (projects and cash) today?

c. What cash flows will the investors in Xia receive? Based on these cash flows, what is the value of Xia today?

d. Suppose Xia pays any unused cash to investors today, rather than investing it. What are the cash flows to the investors in this case? What is the value of Xia now?

e. Explain the relationship in your answers to parts (b), (c), and (d).

Question 3: The table here shows the no-arbitrage prices of securities A and B that we calculated.

|

Security

|

Market PriceToday

|

Cash Flow

Weak Economy

|

In One Year

Strong Economy

|

|

Security A

|

231

|

0

|

600

|

|

Security B

|

346

|

600

|

0

|

a. What are the payoffs of a portfolio of one share of security A and one share of security B?

b. What is the market price of this portfolio? What expected return will you earn from holding this portfolio?

c. If these are the only two possible states of the economy? Explain why your answer in b above is the risk free rate.

Assignment Part 2: Time Value of Money Problems

Question 4: Joe, a Carlson School graduate you recently hired, needs $40,000 in 3 years to buy the car of his dreams. If his investments earn 6% interest per year, how much must he invest today?

Question 5: Since Joe does not have enough cash today to meet his goal he decides he should to invest equal amounts over the next three years beginning at the end of this year. If the fair interest rate is 6% annually, how much will he need to invest each year?

Question 6: How much would Joe need to invest annually if he invests an equal amount over the next three years beginning immediately (three payments total)?

Question 7: The great, great grandparents of one of your classmates sold their factory to the government 104 years ago for $150,000. If these proceeds had been invested at 4% per year, how much would this legacy be worth today? Assume annual compounding.

Question 8: An investment today of $9,775 is worth $15,000 in 8 years. At what rate has your investment been growing (annually) over the 8 years?

Question 9: In her will, your aunt set up a trust that is required to pay you the sum of $5,000 a year forever with payments starting immediately so you will receive $5,000 today. However, the news is better. She has specified that this $5,000 should grow at 3% per year. Given an interest rate of 10%, what is the PV of the inheritance?

Question 10: After your grandmother retired, she purchased an annuity contract for $250,000 that will pay her $25,000 at the end of every year, starting at the end of this year, until she dies. The appropriate interest rate for this annuity is 8%. How many years must your grandmother live for the value today of the $25,000 annual payments to exceed the purchase price of $250,000.

Assignment Part 3: Retirement Problems

Question 11: You believe you will need $125,000 annually to live comfortably while retired. You plan on retiring when you are 65 and will begin withdrawing funds from your retirement account on your 66th birthday. If you expect to need 30 years of retirement income how much money will you need at retirement (when you are 65) to meet this goal assuming the fair interest rate is 7%?

Question 12: If today is your 35th birthday, and you decide, starting next year and on every birthday up to and including your 65th birthday (30 years total), you will invest the same amount how much must you invest annually. To meet the retirement savings goal you have set in #17 above? Again the fair interest rate is 7% annually.

Question 13: You realize that in the analysis above you forgot to include the impact of inflation. Recalculate the answer to # 17assuming inflation is 3% per year (the real rate is 3.89%) and the $125,000 annually is stated in real dollars instead of nominal dollars.

Question 14: Given your new answer above in real dollars, calculate the amount you must invest annually in real dollars to meet your retirement goal. Again assume 7% is the fair nominal rate and inflation is 3% per year (the real rate is 3.89%).

Question 15: The annual payments you calculated in the previous problem are in real dollars. Since your first annual investment will be made next year, what is the nominal (actual) amount you need to invest next year to account for inflation?

Question 16: Based on the real dollar value you calculated in #19 above, how much will you need in your retirement account in nominal dollars when you retire at age 65?

Question 17: Based on the $125,000 real dollar annual required withdrawals from your retirement account, what amount will you withdraw from your retirement account, in nominal dollars, on your 66th birthday, the first year of retirement? What is the amount in nominal dollars will you withdraw from your retirement account on your 85th birthday?

Assignment Part 4: Interest Rate Method Problems

Question 18: You are in the process of purchasing a new automobile that will cost you $27,500. The dealership is offering you either a $2,500 rebate (applied toward the purchase price) or financing at a 0.9% APR for 48 months (with payments made at the end of the month) and no rebate. You have been pre-approved for an auto loan through your local credit union at an interest rate of 5.5% APR for 48 months. If you take the $2,500 rebate and finance your new car through your credit union calculate your monthly payments.

Question 19: Calculate the monthly payments if you forgo the $2,500 rebate and finance your new car through the dealership.

Assignment Part 5: Investment Decision Rule Problems

Question 20: A $25 investment produces $27.50 at the end of the year with no risk. If the OCC = 10% annually is this a good investment?

Question 21: The Wilson Landscaping Company can purchase a piece of equipment for $3,600 today. The asset has a two-year life, will produce a cash flow of $600 in the first year and $4,200 in the second year. The fair interest rate is 15%. Calculate the project's IRR and NPV. Should the project be taken?

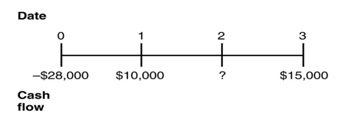

Question 22: You are offered an investment opportunity that costs you $28,000,has an NPV of $2278, lasts for three years, and produces the following cash flows:

If the OCC = 10% what is the missing cash flow?

Assignment Part 6: Short Answer Questions

Question 23: Explain the Valuation Principle using your own words.

Question 24: Since most things do not trade in competitive markets, why is the Law of One Price useful when calculating the value added from a business decision?

Question 25: If the risk free yield curve is upward sloping (long term risk free interest rates are higher than short term risk free interest rates), what is this likely to imply about investor's expectations of future interest rates?

Question 26: Explain why accepting positive NPV projects benefits firm investors.

Question 27: What are the limitations of the payback rule as a decision rule?

Question 28: Describe two common advantages of NPV over the IRR rule when comparing mutually exclusive projects.

Are you in the quest for the most reliable online Market Price of Portfolio Assignment Help service for securing notable grades? Hire our professional tutors right now and boost up your academic growth with ease!

Tags: Market Price of Portfolio Assignment Help, Market Price of Portfolio Homework Help, Market Price of Portfolio Coursework, Market Price of Portfolio Solved Assignments, NPV Assignment Help, NPV Homework Help, Time Value of Money Assignment Help, Time Value of Money Homework Help, Retirement Assignment Help, Retirement Homework Help, Interest Rate Method Assignment Help, Interest Rate Method Homework Help, Investment Decision Assignment Help, Investment Decision Homework Help