1. Cost of goods sold is given by:

a. Beginning inventory - net purchases + ending inventory

b. Beginning inventory + accounts payable - net purchases.

c. Net purchases + ending inventory - beginning inventory.

d. Net purchases - ending inventory + beginning inventory.

e. Net Purchases + beginning inventory - ending inventory.

f. None of the above.

2. The Mateo Corporation's inventory at December 31, 2011, was $325,000 based on a physical count priced at cost, and before any necessary adjustment for the following:

• Merchandise costing $30,000, shipped F.o.b. shipping point from a vendor on December 30, 2011, was received on January 5, 2012.

- Merchandise costing $22,000, shipped F.o.b. destination from a vendor on December 28, 2011, was received on January 3, 2012.

• Merchandise costing $38,000 was shipped to a customer F.o.b. destination on December 28, arrived at the customer's location on January 6, 2012.

- Merchandise costing $12,000 was being held on consignment by Traynor Company.

What amount should Mateo Corporation report as inventory in its December 31, 2011, balance sheet?

a. $367,000.

b. $427,000.

c. $325,000.

d. $355,000.

e. $363,000.

f. $347,000.

g. None of the above

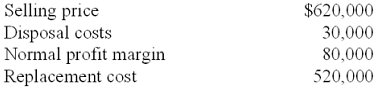

3. Montana Co. has determined its year-end inventory on a FIFO basis to be $600,000.

Information pertaining to that inventory is as follows:

What should be the carrying value of Montana's inventory under lower of cost or market?

a. $600,000.

b. $620,000.

c. $570,000.

d. $520,000.

e. $590,000.

f. $510,000.

g. None of the above

4. Wilson Inc. owns equipment for which it paid $70 million. At the end of 2011, it had accumulated depreciation on the equipment of $12 million. Due to adverse economic conditions, Wilson's management determined that it should assess whether an impairment should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $60 million, and the equipment's fair value at that point is $50 million. Under these circumstances, Wilson:

a. Would record a $10 million impairment loss on the equipment.

b. Would record a $12 million impairment loss on the equipment

c. Would record a $2 million gain to write up the value of the equipment.

d. Would record no impairment loss on the equipment.

e. Would record an $8 million impairment loss on the equipment.

f. Would record a $20 million impairment loss on the equipment.

g. None of the above is correct.

5. Sloan Company has owned an investment during 2011 that has increased in fair value. After all closing entries for 2011 are completed, the effect of the increase in fair value on total shareholders' equity would be:

a. higher under the available-for-sale approach than under the trading-securities approach.

b. lower under the available-for-sale approach than under the trading-securities approach.

c. the same amount under the available-for-sale and trading-securities approaches.

d. not possible to identify whether the available-for-sale or trading-securities approaches yield higher shareholders' equity given this information.

e. None of the above.

6. Sox Corporation purchased a 40% interest in Hack Corporation for $1,500,000 on Jan 1, 2011. On November 1, 2011, Hack declared and paid $1 million in dividends. On December 31, Hack reported a net loss of $6 million for the year. What amount of loss should Sox report on its income statement for 2011 relative to its investment in Hack?

a. $1,100,000.

b. $2,400,000.

c. $500,000.

d. $5,500,000

e. $1,500,000.

f. $1,600,000.

g. None of the above.

7. Murgatroyd Co. purchased equipment on 1/1/09 for $500,000, estimating a four-year useful life and no residual value. In 2009 and 2010, Murgatroyd depreciated the asset using the sum-of-years'-digits method. In 2011, Murgatroyd changed to straight-line depreciation for this equipment. What depreciation would Murgatroyd record for the year 2011 on this equipment?

a. $150,000.

b. $50,000.

c. $100,000.

d. $37,500

e. $125,000.

f. $75,000.

g. None of the above is correct.