Valuation of Virgin America Inc.

This problem requires you, among other things, to estimate the stock price for Virgin America Inc. (Ticker: VA), and provide the analysis as requested. You will need to use “Sources of Financial Data” listed in Course Content1 to obtain the necessary financial info/statements for Virgin America Inc., to identify its peer companies and to obtain pricing and financial information for them.

A. Choose several peer companies for Virgin America Inc. and justify your choice. Choose several valuation multiples and using comparable ratios of peer companies and Virgin America Inc. financial information from prospectus, estimate the company’s equity value on April 3, 2016. It is required for this question to list your major assumptions and properly reference sources of information that you used in your calculations.

B. Using the same peers and industry data, please estimate Virgin America Inc.’s WACC. Show all your data used for calculations. Again, please state all your assumptions and sources of information.

C. On April 4, 2016 Alaska Air Group Inc. (Ticker: ALK) announced its intent to buy Virgin America Inc. How do your valuations compare to the Alaska Air Group Inc. announced acquisition price? If your valuations differ from observed prices, can you briefly forward any possible explanations? For example, you should discuss and attempt to evaluate possible synergy and other effects of acquisition.

D. The following information is for pedagogical purposes only and unlike earlier questions does not deal with real terms of the deal. In July 2015 Virgin America and ViaSat (Ticker: VSAT) announced a Joint Venture (JV) to provide Wi-Fi service on-board.

ViaSat has invested $ 5 M in the venture in return for 10% ownership in the form of convertible preferred shares. By July 2016 JV is expected to generate $ 5 M in revenues with subsequent 25% annual growth. ViaSat anticipates to sell its share in JV in July 2019.

Applying Value/Sales ratio of 16, what is the estimated 2019 value of ViaSat share in JV? What is the ViaSat’'s implied cost of capital that justified the $ 10 M investment? How would your answers change if the annual growth were only 20%? What is the advantage of having convertible preferred instead of common equity?

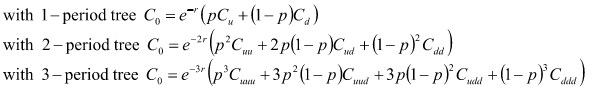

E. The following information is for pedagogical purposes only and unlike earlier questions does not deal with real situation. There are rumors that Virgin America is negotiating a three year agreement with Amazon (Ticker: AMZN) according to which Virgin America will have a right to stream Amazon Prime content on its flights at a predetermined annual price of $ 50 M. Currently Virgin America uses Netflix (Ticker: NFLX) streaming and pays $ 40 M annually, but each year this value can go up 20% or down 10% in comparison with the previous year. Over the next three years at the beginning of each year Virgin America can decide, which provider, Netflix or Amazon Prime, it will be using that year. Which product should the company use each year? If the risk-free rate is 3%, how much this agreement is worth to Virgin America? Please provide as many details as possible in your explanations and support them by numbers. Hint: think about this as a series of options. Also you might find the following option pricing formulas useful (r is the risk-free rate, p is the risk-neutral probability, Cn is the option payoff in node n)

Make sure to justify your responses by using the available data/info and carrying out any needed and relevant calculations.

Attachment:- template.xlsx