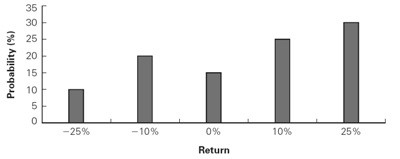

1.The figure below shows the one-year return distribution for RCS stock. Calculate

a. The expected return.

b. The standard deviation of the return.

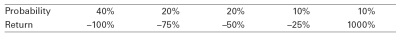

2.The following table shows the one-year return distribution of Startup, Inc. Calculate

a. The expected return.

b. The standard deviation of the return.

3.Characterize the difference between the two stocks in Problems 1 and 2. What trade-offs would you face in choosing one to hold?