1. Calculating Cost of Equity The Dybvig Corporation's common stock has a beta of 1.21. If the risk-free rate is 3.5 percent and the expected return on the market is 11 percent, what is Dybvig's cost of equity capital?

2. Calculating Cost of Debt Advance, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 17 years to maturity that is quoted at 95 percent of face value. The issue makes semiannual payments and has a coupon

3. Calculating WACC Mullineaux Corporation has a target capital structure of 70 percent common stock and 30 percent debt. Its cost of equity is 13 percent, and the cost of debt is 6 percent. The relevant tax rate is 35 percent. What is Mullineaux's WACC?

4. Finding the WACC Titan Mining Corporation has 9.3 million shares of common stock outstanding and 260,000 6.8 percent semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $34 per share and has a beta of 1.20, and the bonds have 20 years to maturity and sell for 104 percent of par. The market risk premium is 7 percent, T-bills are yielding 3.5 percent, and Titan Mining's tax rate is 35 percent.

a. What is the firm's market value capital structure?

b. If Titan Mining is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows?

5. Calculating Project NPV The Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 34 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net workingcapital is recovered at the end of the project.

a. Compute the incremental net income of the investment for each year.

b. Compute the incremental cash flows of the investment for each year.

c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project?

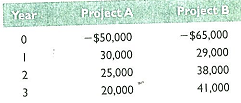

6. Capital Budgeting with Inflation Consider the following cash flows on two mutually exclusive projects:

The cash flows of project A are expressed in real terms, whereas those of project B are expressed in nominal terms. The appropriate nominal discount rate is 13 percent and the inflation rate is 4 percent. Which project should you choose?

7. Calculating NPV and IRR for a Replacement A firm is considering an investment in a new machine with a price of $18 million to replace its existing machine. The current machine has a book value of $6 million and a market value of $4.5 million. The new machine is expected to have a four-year life, and the old machine has four years left in which it can be used. If the firm replaces the old machine with the new machine, it expects to save $6.7 million in operating costs eacli year over the next four years. Both machines will have no salvage value in four years. If the firm purchases the new machine, it will also need an investment of $250,000 in net working capital. The required return on the investment is 10 percent, and the tax rate is 39 percent. What are the NPV and IRR of the decision to replace the old machine?

8. Project Analysis McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $875 per set and have a variable cost of $430 per set. The company has spent $150,000 for a marketing study that determined the company will sell 60,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 12,000 sets of its high-priced clubs. The high-priced clubs sell at $1,100 and have variable costs of $620. The company will also increase sales of its cheap clubs by 15,000 sets. The cheap clubs sell for $400 and have variable costs of $210 per set. The fixed costs each year will be $9,300,000. The company has also spent $1,000,000 on research and development for the new clubs. The plant and equipment required will cost $29,400,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1,400,000 that will be returned at the end of the project. The tax rate is 40 percent, and the cost of capital is 14 percent. Calculate the payback period, the NPV, and the IRR.

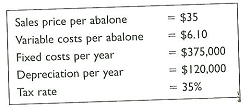

9. Financial Break-even Analysis You are considering investing in a company that cultivates abalone for sale to local restaurants. Use the following information:

The discount rate for the company is 15 percent, the initial investment in equipment is $840,000, and the project's economic life is seven years. Assume the equipment is depreciated on a straight-line basis over the project's life.

a. What is the accounting break-even level for the project?

b. What is the financial break-even level for the project?

10. Break-even Intuition Consider a project with a required return of R percent mat costs $./ and will last for N years. The project uses straight-line depreciation to zero over the N-year life; there are neither salvage value nor net working capital requirements.

a. At the accounting break-even level of output, what is the IRR of this project? The payback 'period? The NPV?

b. At the cash break-even level of output, what is the IRR of this project? The payback period? The NPV?

c. At the financial break-even level of output, what is the IRR of this project? The payback period? The NPV?

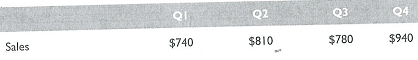

11. Calculating Cash Collections The Litzenberger Company has projected the following quarterly sales amounts for the coming year:

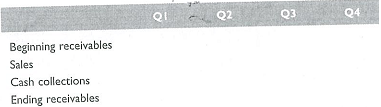

a. Accounts receivable at the beginning of the year are $310. Litzenberger has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following:

b. Rework (a) assuming a collection period of 60 days.

c. Rework (a) assuming a collection period of 30 days.

12. Changes in the Cash Account Indicate the impact of the following corporate actions on cash, using the letter I for an increase, D for a decrease, or N when no change occurs.

a. A dividend is paid with funds received from a sale of debt.

b. Real estate is purchased and paid for with short-term debt.

c. InventEiry is bought on credit.

d. A short-term bank loan is repaid.

e. Next year's taxes are prepaid.

f. Preferred stock is redeemed.

g. Sales are made on credit.

h. Interest on long-term debt is paid.

i. Payments for previous sales are collected.

j. The accounts payable balance is reduced.

k. A dividend is paid.

I. Production supplies are purchased and paid with a short-term note.

m. Utility bills are paid.

n. Cash is paid for raw materials purchased for inventory.

o. Marketable securities are sold.

13. Exchange Rates Are exchange rate changes necessarily good or bad for a particular company?

14. Multinational Corporations Given that many multinationals based in many countries have much greater sales outside their domestic markets than within them, what is the particular relevance of their domestic currency?

15. Exchange Rate Risk If you are an exporter who must make payments in foreign currency three months after receiving each shipment and you predict that the domestic currency will appreciate in value over this period, is there any value in hedging your currency exposure?

16. Forward Exchange Rates Use the information in Figure 31.1 to answer the following questions:

a. What is the six-month forward rate for the Japanese yen in yen per U.S. dollar? Is the yen selling at a premium or a discount? Explain.

b. What is the three-month forward rate for British pounds in U.S. dollars per pound? Is the dollar selling at a premium or a discount? Explain.

c. What do you think will happen to the value of the dollar relative to the yen and the pound, based on the information in the figure? Explain.