Question 1: Since Fama recognized the 3 forms of proficient market in the year 1960’s there have been a number of studies recognizing conditions where the market appears not to be proficient. Identify and describe the three forms of market efficiency recognized by Fama and describe why he considers that the anomalies don’t invalidate the theory as he described in his 1998 paper “Market efficiency, long term returns and behavioral finance”.

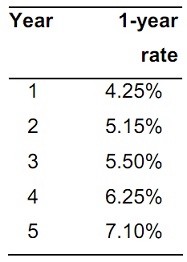

Question 2: Government economists have forecasted one-year T-bill rates for the given 5-years, as shown below:

You have liquidity premium 0.25% for the next two years and 0.50% thereafter. Would you be willing to purchase a four-year T-bond at a 5.75% interest rate?

Question 3: Little Monsters Inc. borrowed Rs 1,000,000 for two years from Northern Bank Inc. at an 11.5% interest rate. The current risk-free rate is 2% and Little Monsters’s financial condition warrants a default risk premium of 3% and a liquidity risk premium of 2%. The maturity risk premium for two-year loan is 1% and inflation is expected to be 3% next year.

Required:

What does this information imply regarding the rate of inflation in the second year?

Question 4: When the economy enters the recession, either a free reserve target or an interest rate target will lead to a slower rate of growth for the money supply. Describe whether the statement is true or false and validate your answer.