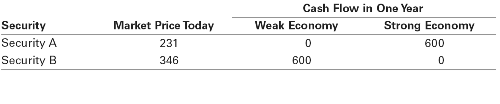

1.The table here shows the no-arbitrage prices of securities A and B that we calculated.

a. What are the payoffs of a portfolio of one share of security A and one share of security B?

b. What is the market price of this portfolio? What expected return will you earn from holding this portfolio?

2.Suppose security C has a payoff of $600 when the economy is weak and $1800 when the economy is strong. The risk-free interest rate is 4%.

a. Security C has the same payoffs as what portfolio of the securities A and B in problem A.1?

b. What is the no-arbitrage price of security C?

c. What is the expected return of security C if both states are equally likely? What is its risk premium?

d. What is the difference between the return of security C when the economy is strong and when it is weak?

e. If security C had a risk premium of 10%, what arbitrage opportunity would be available?