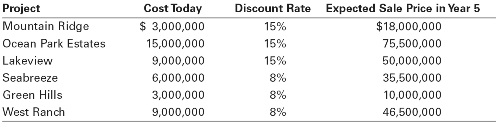

1.Kaimalino Properties (KP) is evaluating six real estate investments. Management plans to buy the properties today and sell them five years from today. The following table summarizes the initial cost and the expected sale price for each property, as well as the appropriate discount rate based on the risk of each venture.

a. What is the IRR of each investment?

b. What is the NPV of each investment?

c. Given its budget of $18,000,000, which properties should KP choose?

d. Explain why the profitably index method could not be used if KP’s budget were $12,000,000 instead. Which properties should KP choose in this case?

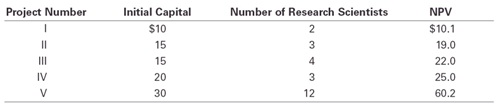

2.Orchid Biotech Company is evaluating several development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects. Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (all cost values are given in millions of dollars).

a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects?

b. Suppose in addition that Orchid currently has only 12 research scientists and does not anticipate being able to hire any more in the near future. How should Orchid prioritize these projects?

c. If instead, Orchid had 15 research scientists available, explain why the profitability index ranking cannot be used to prioritize projects. Which projects should it choose now?

Project PI NPV/Headcount

I 1.01 5.1

II 1.27 6.3

III 1.47 5.5

IV 1.25 8.3

V 2.01 5.0