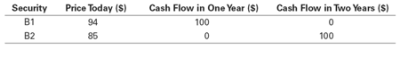

1.Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here:

a. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $100 in two years?

b. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $500 in two years?

c. Suppose a security with cash flows of $50 in one year and $100 in two years is trading for a price of $130. What arbitrage opportunity is available?

2.Suppose a security with a risk-free cash flow of $150 in one year trades for $140 today. If there are no arbitrage opportunities, what is the current risk-free interest rate?