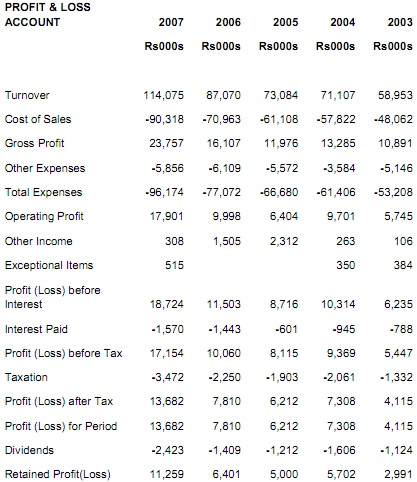

Problem1. Study the profit and loss account of Ocean Flyers Ltd and answer the questions that follow:

Question1. What do you understand by the term return on sales? In brief comment on its behaviour throughout the period 2003-2007.

Question2. Compute the interest cover. Comment on the result for entire period.

Question3. In 2007 the issued share capital of Indian Ocean Flyers Ltd was worth Rs 3.192 million and was made up of 12,768 shares. Calculate (i) the nominal value of shares and (ii) the earnings per share.

Question4. The current market price of shares in this company is Rs 8,560. Taking the earnings per share (EPS) for 2007, what is the current price-to-earnings (PE) ratio for firm?

Question5. Comment on what has been happening to profits and dividends throughout the period.

Question6. Why could a firm that shows profits still face severe difficulties of financial nature?

Question7. What steps would you take to remedy the financial difficulties of such company and why?