Problem: The following data pertain to Brown Brother’s Company operations for July.

Total Product X Product Y

Number of units sold... 10,000 12,000

Selling price per unit... $20,000 $25.00

Variable cost per unit:

Production... $9 $10.00

Selling & administration... $3 $3.75

Fixed Costs:

Production.... $155,000

Selling & administrative... $20,000

Only $50,000 of the fixed production costs is traceable to the production of Product X and $75,000 is traceable to Product Y. All of the selling and administrative costs are common costs that cannot be traced to either product.

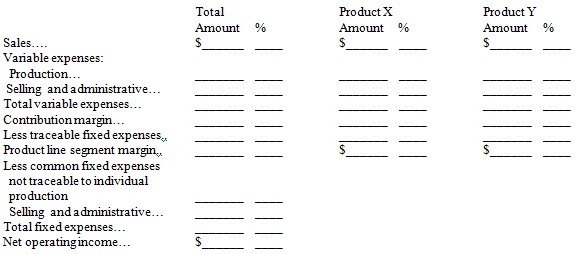

Q1. Prepare a segmented income statement for Brown Brother’s using the following form:

Brown Brother’s

Income Statement

For the month ended July 31

Q2. Should either Product X or Product Y be dropped? Why?

Q3. Product X can be enhanced by incurring an additional $25,000 in fixed production costs. The company would not increase the product’s selling price, but the enhancement should result in increased unit sales. If increased by $80,000, should the product be enhanced?