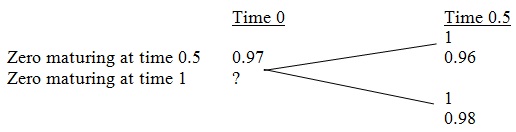

Problem: At time 0.5, the price of $1 par of a zero maturing at time 1 will be either $0.96 or $0.98. The risk-neutral probability of the each outcome is 50%. The current price of $1 par of a zero maturing at time 0.5 is 0.97.

1) What is the price at time 0 of the zero maturing at time 1 in the absence of arbitrage?

b) Multiple choice question. Pick one answer.

Question: Which of the two zeroes above has the higher true expected return from time 0 to time 0.5?

Answer 1: The 0.5-year zero.

Answer 2: The 1-year zero.

Answer 3: They have the same true expected return.

Answer 4: There is not enough information provided to tell.