Problem 1. On a downward sloping linear demand curve, total revenue would be at a maximum at the

a. midpoint of the demand curve.

b. lower end of the demand curve.

c. upper end of the demand curve.

d. It is impossible to tell without knowing prices and quantities demanded.

Problem 2. A legal minimum price at which a good can be sold is a price

a. cut.

b. stabilization.

c. ceiling.

d. floor.

Problem 3. A binding price ceiling causes

a. a shortage, which cannot be eliminated through market adjustment.

b. a surplus, which cannot be eliminated through market adjustment.

c. a shortage, which is temporary, since market adjustment will cause price to rise.

d. a surplus, which is temporary, since market adjustment will cause price to rise.

Problem 4. Suppose the government wants to alleviate the harm of smoking by reducing the consumption of cigarettes, illustrate each of these proposed policies in a supply-and-demand diagram of the cigarette market. On each graph, mark the initial equilibrium(Q1, P1)and the new price(P2) and new quantity(Q2).

a. a tax on cigarette buyers

b. a tax on cigarette sellers

c. a price floor on cigarettes

d. a tax on tobacco suppliers

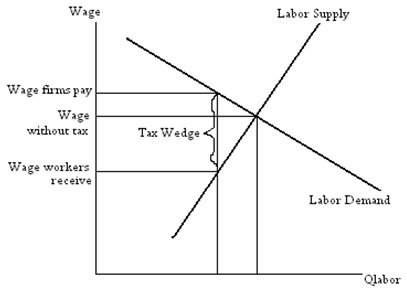

Problem 5. The federal government uses the revenue from the FICA tax to pay for Social Security and Medicare, the income support and health care programs for elderly. FICA is an example of a payroll tax, which is a tax on the wages that firms pay their workers. The key feature of payroll tax is that it places a wedge between the wage that firms pay and the wage that workers receive. Suppose the labor market is like the following graph:

In this graph, the labor demand equation is PD=-0.1QD+7, the labor supply equation is PS=0.4QS-3. The government wants to place a wedge of 1$/hr between supply and demand.

a. Find the equilibrium quantity and wage of this labor market before the government interferes in the market;

b. Suppose the government places a excise tax of $1 per unit of labor on suppliers in this market.

i) What is the wage that firm will pay once this tax is imposed?

ii) What is the net wage that workers will receive once this tax is imposed?

c. Compute the price elasticity of demand and supply of labor from Q1(the initial pre-tax equilibrium)to Q2 (the after-tax equilibrium).

d. Given the results in (c), will demanders of labor(firms) or suppliers of labor(workers) face a heavier economic tax burden?

e. With the excise tax of $1 per unit of labor, what is the economic incidence of the tax on firms hiring labor (i.e. consumer tax incidence)?

f. With the excise tax of $1 per unit of labor, what is the economic incidence of the tax on suppliers of labor (i.e. producer tax incidence)?

g. How much tax revenue will the government collect from this tax?

h. What is the deadweight loss associated with this tax?

i. If the excise tax is doubled, how big is the deadweight loss?

j. Does it matter if this tax is levied on suppliers or on demanders? Explain your answer.

Problem 6. In 1973, OPEC raised the price of crude oil in world oil markets. Because crude oil is the major input used to make gasoline, the higher oil prices reduced the supply of gasoline. Suppose that the government was concerned about rising price due to OPEC’s actions, decided to subsidize consumers of gasoline(in reality, the government enacted price controls instead of a subsidy in the early 1970’s). The graph below illustrates both OPEC’s actions as well as the subsidy to consumers.

Suppose the supply equation of gasoline initially (S1) is PS1=QS1-1.5, the demand curve initially(D1) is PD1=-QD1+4.5. After OPEC raised the price of crude oil, the new supply curve(S2) is PS2=QS2-0.5.

a. Initially, before OPEC’s action, what were the equilibrium quantity and equilibrium price in the gasoline market?

b. After OPEC raised the price of crude oil, What were the new equilibrium quantity and new equilibrium price?

c. Suppose the government subsidized consumers of gasoline an amount per gallon equal to the increase per gallon in (b),what is the new demand equation(D2)

d. Given OPEC’s actions and the subsidy in (c), what were the new equilibrium quantity and new equilibrium price in the market?

e. Based on (d)

i) what was the gross price the consumers of gasoline pay?

ii) What was the net price(net of the subsidy) that the consumers of gasoline pay?

iii) What was the price OPEC received?

iv) How much of the subsidy did the consumers of gasoline receive?

v) How much of the subsidy goes to OPEC?

f. What’s the government’s total expenditure on the subsidy?

g. How much of the government’s expenditure on the subsidy did OPEC get?

h. How much of the government’s expenditure on the subsidy did the consumers of gasoline get?

i. From this problem, what lesson would you get?