1.Explain what the size effect is.

2.Assume all firms have the same expected dividends. If they have different expected returns, how will their market values and expected returns be related? What about the relation between their dividend yields and expected returns?

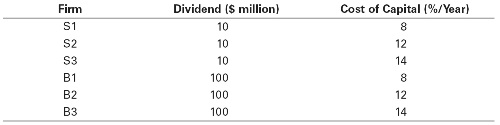

3.Each of the six firms in the table below is expected to pay the listed dividend payment every year in perpetuity.

a. Using the cost of capital in the table, calculate the market value of each firm.

b. Rank the three S firms by their market values and look at how their cost of capital is ordered. What would be the expected return for a self-financing portfolio that went long on the firm with the largest market value and shorted the firm with the lowest market value? (The expected return of a self-financing portfolio is the weighted average return of the constituent securities.) Repeat using the B firms.

c. Rank all six firms by their market values. How does this ranking order the cost of capital? What would be the expected return for a self-financing portfolio that went long on the firm with the largest market value and shorted the firm with the lowest market value?

d. Repeat part (c) but rank the firms by the dividend yield instead of the market value. What can you conclude about the dividend yield ranking compared to the market value ranking?