QUESTION 1 - A Cross-sectional study

The data you need for this question is on the sheet Companies. There are figures on current assets (CA) and current liabilities (CL) sourced from the Osiris database for South Korean companies. In this question you will be testing to see if the current ratio (CR) is constant on average for a set of these firms. Use a level of significance of a = 0.05 for this question.

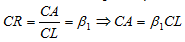

Assuming the current ratio is constant and equal to b1, we have:

This implies that the intercept should be equal to zero when a simple linear regression model is fitted.

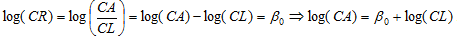

If we take logs the restriction changes to:

This implies that the slope should be one when the logs are used.

(a) Produce two scatter plots, one of the raw data and one using the logs. Comment on how well a straight line will fit the data in both cases. Which one do you think is likely to produce the more reliable test statistics?

(b) Estimate simple linear regression models for both the raw data and the logs, estimating both the intercept and the slope.

(c) Test to see whether the current ratio is constant using the raw data.

(d) Test to see if the current ratio is constant using the logged data.

(e) Do your answers from parts (c) and (d) agree? If not briefly explain which you think is the most reliable.

QUESTION 2 - A Time Series Study

You will now consider the relationship between exports and imports for North Korea. To do this you have been provided with monthly data sourced from the DataStream database starting in 1981.Both series are measure in millions of US dollars, are in current prices and were originally sourced from the IMF Direction of Trade Statistics.

(a) Decide if any data transformations should be carried out. You may find line graphs useful.Briefly discuss any transformations you have decided to use and why.

(b) Many countries import materials that are used to manufacture goods for exports. Estimate a model that assumes exports depends on imports in the previous period.

(c) Evaluate your model using the information in the statistical output and your economic knowledge.

(d) Look at the graphs of Actual - Fitted - Residual. Does this indicate any potential problems with your model?

QUESTION 3 - The Market Model

The data set on the sheet called shares contains five years of monthly stock prices for 100 publicly listed companies in South Korea, the primary stock exchange index, the KOSPI, and some other series, which will be used in latter tutorials. Go to the column in the sheet shares that has the same letter as the first letter in your family name (unless your family name starts with A or B, in which case go to AA & AB) to select the name of the firm you will use for this question and latter tutorials(for example I would use SAMSUNG FIRE & MAR.IN.PF as it is in column S and my family name is Stewart). You will calculate the beta of this stock using the market model.

Rit = b0 + b1RMt + ut

(a) Using the KOSPI (which is column B of this sheet) as the market index, calculate the returns on the market and your stock and plot these on a scatter diagram. Do not print out the values for these returns - the scatter plot is sufficient.

(b) Use these returns to estimate the market model for your chosen share.

(c) Test to see whether the beta value you obtain indicates the stock is aggressive, passive or neutral? That is, is the slope >, < or = 1?

(d) How much of the variation in returns is caused by market factors. Give a measure of systematic risk for your firm and one of non-systematic risk.