I. Binary Choice Questions:

Problem 1. Consider a situation where Joe has loaned Bob $10,000. The two men have agreed on the terms of this loan and Bob has promised to pay Joe back the money plus a payment that reflects a nominal payment equal to 10% of the loan. Given this agreement, Joe will pay Bob back a total of _______. We also know that given this agreement Bob will be made better off if ________.

a. $11,000; there is unanticipated deflation

b. $11,000; there is unanticipated inflation

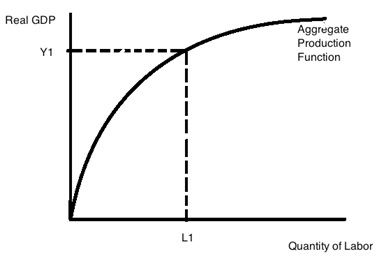

Problem 2. Consider the aggregate production function for Silvia, a small economy. This aggregate production function has the following shape:

Suppose this economy hires more capital while holding its use of labor constant. Given this information and the above graph,

a. Labor productivity will increase as will the level of real GDP for this economy.

b. Labor productivity will decrease and the level of real GDP for this economy will increase.

Problem 3. Mason graduated from technical college in June 2014 and spent the month of June visiting the West Coast. In July he began to search for a position and so far he has applied for twenty jobs but has not yet received a job offer. For purposes of unemployment measurement Mason would be counted as

a. Structurally unemployed.

b. Frictionally unemployed.

Problem 4. Nominal GDP in 2013 was $250 million in Beesville. In 2014 nominal GDP was $300 million in Beesville. According to the GDP deflator calculated for Beesville, real GDPdid not change in these two years. Given this information,

a. We can conclude that the GDP deflator for 2014 was smaller than the GDP deflator for 2013.

b. We can conclude that the GDP deflator for 2014 was larger than the GDP deflator for 2013.

Problem 5. Economists expect that a well-performing economy will not have a unemployment rate equal to 0% because

a. An economy will always have some frictional and structural unemployment.

b. An economy will always have some frictional, structural and cyclical unemployment.

II. Multiple Choice Questions

Problem 6. Suppose that real GDP per capita in China is growing at 5% a year and that real GDP per capita in the U.S. is growing at 2% a year. In 2014, suppose real GDP per capita in China is $5,000 while in the U.S. real GDP per capita is $50,000. Given this information and holding everything else constant, which of the following statements is true?

a. In 70 years U.S. real GDP per capita will be less than China's real GDP per capita.

b. In 70 years U.S. real GDP per capita will be approximately $40,000 higher than China's real GDP per capita.

c. In 70 years U.S. real GDP per capita will be approximately equal to China's real GDP per capita.

d. In 70 years U.S. real GDP per capita will be five times bigger than China's real GDP per capita rather than ten times bigger.

Problem 7. The U.S. Bureau of Economic Analysis reported in March 2014 that U.S. real GDP for the year was slightly less than $16 trillion dollars. The World Bank estimates that approximately 10% of U.S. real GDP is collected by the government through its tax collections. According to U.S. News and World Report the size of the underground or "shadow" economy is estimated to be between 8 to 14% of real GDP in the U.S. Economists believe that this shadow economy has grown in recent years due to the difficulty of finding legal employment for some individuals. (These are reasonably "accurate numbers" found by searching legitimate sources on the internet.) Given this information the underground economy costs the government taxing authorities to lose approximately

a. $1.6 trillion dollars last year.

b. $128 billion dollars to $224 billion dollars last year.

c. $128 million dollars to $224 million dollars last year.

d. $12.8 billion dollars to $22.4 billion dollars last year.

e. $1.28 trillion dollars to $2.24 trillion dollars last year.

Use the following information to answer the next two questions.

You are given the following information about an economy. For this economy you are told that the market basket for purposes of computing the inflation rate in the economy has been defined as 5 sandwiches and 8 half-pints of milk.

|

|

Quantity in 2010

|

Price in 2010

|

Quantity in 2011

|

Price in 2011

|

|

Sandwiches

|

100

|

$2

|

80

|

$4

|

|

Half-pints of Milk

|

20

|

$3.50

|

40

|

$2

|

Problem 8. If the base year is 2010, what is the value of the GDP deflator for 2011 on a 100 point scale?

a. 75

b.94.7

c.105.6

d. 133.3

Problem 9. If the base year is 2010, what is the rate of inflation using the CPI between 2010 and 2011?

a. Approximately 5.3%

b. Approximately 33.3%

c. Approximately -33.3%

d. Approximately -5.3%

Problem 10. Penny currently earns $40,000 a year at her job. She anticipates that inflation will be 10% next year and her expects that her employer will adjust her nominal income so that she has the same purchasing power as she has this year. Given this information, Penny's nominal income for next year will be equal to ________ and her real income will be equal to _______.

a. $44,000; $44,000

b. $44,000; $40,000

c. $44,000; $48,400

d. $40,000; $44,000

Problem 11. Susie expects inflation to be 10% next year. She wants to earn a real return on her savings of 4% for the year. Given this information Susie should lend out her savings at a nominal interest rate of ________. If unanticipated inflation ends up being 2% higher than Susie anticipates this will result in _______.

a. 14%; Susie being worse off

b. 14%; Susie being better off

c. 6%; Susie being worse off

d. 6 %; Susie being better off

e. 10%; Susie being worse off

Problem 12. When the economy is operating at its natural rate of unemployment then

a. Cyclical unemployment is equal to 0%.

b. Frictional unemployment has been eliminated.

c. Structural unemployment has been eliminated.

d. Answers (a), (b), and (c) are all true answers.

e. Answers (b) and (c) are true answers.

Problem 13. Sheila is graduating at the end of summer school with a degree in accounting. She has gotten four job offers for similar work and her only preference is to take the job that promises the greatest purchasing power during her first year at work. Here are the offers she has received:

|

Job Offer

|

Annual Salary

|

|

Job in New York City

|

$80,000

|

|

Job in Chicago

|

$50,000

|

|

Job in San Francisco

|

$120,000

|

|

Job in Miami

|

$75,000

|

From her economics class Sheila knows she should measure this purchasing power using a constant rather than a current dollar: so she has gone to the web and found government provided data on the cost of living in each of these cities. Here is the data she found:

|

City

|

CPI for this year

|

|

New York City

|

200

|

|

Chicago

|

100

|

|

San Francisco

|

250

|

|

Miami

|

175

|

Given this information, which of these offers is the WORSE one for Sheila?

a. New York City

b. Miami

c. San Francisco

d. Chicago

Problem 14. Betty, who lives in Sylvania (a small country), bought $400 worth of goods and services last week. Included in this amount was $50 of cheese produced in the United States, $75 worth of Italian wine, and $10 worth of socks manufactured in China. Everything else Betty purchased last week was produced in Sylvania. From this information, we can calculate that

a. Betty's contribution to GDP in Sylvania last week would be calculated as $400 since that is what she spent.

b. Betty's contribution to GDP in Sylvania last week would be calculated as $400 worth of consumption plus $135 worth of imports, for a total contribution to GDP of $535 for the week.

c. Betty's contribution to GDP in Sylvania last week would be calculated as $400 worth of consumption minus $135 worth of imports, for a total contribution to GDP of $265 for the week.

d. Betty's contribution to GDP in Sylvania last week would be calculated as $265 plus the value of her labor for the week.

e. Betty's contribution to GDP in Sylvania last week would be calculated as $265 plus the value of her labor for the week and the value of the capital she provided for the week.

Use the following information to answer the next two questions.

The table below provides information about the economic production that occurred in Monrovia in 2013 and 2014. For purposes of computing the CPI in Monrovia the base year is 2013 and the market basket is defined as 4 pounds of beef and 2 pounds of butter.

|

Year

|

Price of Item in 2013

|

Quantity of Item in 2013

|

Price of Item in 2014

|

Quantity of Item in 2014

|

|

Beef

|

$5.00 per pound

|

100 pounds

|

$6.00

|

200 pounds

|

|

Butter

|

$2.00 per pound

|

200 pounds

|

$1.00

|

300 pounds

|

Problem 15. Given the above information, the value of the CPI in 2014 measured on a 100 point scale is

a. (cost of market basket in 2014)/(cost of market basket in 2013) * 100

b. (cost of market basket in 2013)/(cost of market basket in 2014) * 100

c. (the sum of the product of the price of the good in 2014*the quantity of the good in 2014 for all the goods in 2014)/(the sum of the product of the price of the good in 2013*the quantity of the good in 2013 for all the goods in 2013) * 100

d. (the sum of the product of the price of the good in 2013*the quantity of the good in 2013 for all the goods in 2013)/(the sum of the product of the price of the good in 2014*the quantity of the good in 2014 for all the goods in 2014) * 100

e. Answers (a) and (c) are both correct answers

Problem 16. Given the above information the inflation rate as measured by the CPI ______ if the base year is changed and the inflation rate as measured by the GDP deflator _________ if the base year is changed.

a. will change; will not change

b. will change; will change

c. will not change; will not change

d. will not change; will change

Use the following information to answer the next two questions.

An economy's aggregate production function is given by the equation

Y = 2K1/2L1/2

where Y is real GDP, K is the number of units of capital and L is the number of units of labor.

You are provided the following information about the labor market in this economy where W is the wage rate per unit of labor:

Demand for Labor: L = 100 - 5W

Supply of Labor: L = 5W - 50

You are also told that capital in this economy is initially equal to 36 units.

Problem 17. Given the following information, which of the following statements is true?

a. The equilibrium amount of labor in this economy is 5 units of labor and the value of real GDP is 60.

b. The equilibrium amount of labor in this economy is 25 units of labor and labor productivity is equal to 2.4 units of output per unit of labor.

c. The equilibrium amount of labor in this economy is 25 units of labor and the value of real GDP is 30.

d. The value of capital productivity in this economy is 1.67 units of output per unit of capital and the value of real GDP is 30.

e. The equilibrium amount of labor in this economy is 25 units of labor and the value of capital productivity is 1.44 units of output per unit of capital.

Problem 18. Suppose the level of technology in this economy increases while holding everything else constant. Given this change, which of the following statement it true?

a. Labor productivity decreases.

b. Labor productivity is unchanged.

c. Capital productivity increases.

d. The level of real GDP produced in this economy decreases since more resources are now being devoted to the production of capital.

e. The level of real GDP produced in this economy is unaffected by this change.

Use the following information to answer the next two questions.

Jose has just won the lottery! He is given the following choices of payout:

Option One: he can receive $1000 invested in a financial asset that pays 10% a year. He can have access to the accumulated funds in 35 years.

Option Two: he can receive $500invested in a financial asset that pays 14% a year. He can have access to the accumulated funds in 35 years.

Option Three: he can receive $2000 invested in a financial asset that pays 7% a year. He can have access to the accumulated funds in 35 years.

Problem 19. Given these options and holding everything else constant, which choice is the best one for Jose if he cares only about getting the highest payout possible?

a. Option One

b. Option Two

c. Option Three

d. Options One and Two are equivalent in value and either will leave Jose as well off as possible.

e. Option One, Two and Three are equivalent in value and any of them will leave Jose as well off as possible.

Problem 20. Now, suppose that Jose has the above options but each option immediately stops payment if Jose dies. Suppose the Jose knew with certainty that he was going to die in 10 years. If Jose only cares about getting the highest payout possible, what is his best option?

a. Option One

b. Option Two

c. Option Three

d. Options One, Two and Three are all equivalent to Jose

Use the information below to answer the next two questions.

Consider an economy where the demand for loanable funds from businesses is given by the following equation where Q is the quantity of loanable funds and r is the interest rate:

Demand for loanable funds from businesses: Q = 50 - 5r

Suppose that the supply of loanable funds from households (private savings) is given by the following equation where Q is the quantity of loanable funds and r is the interest rate:

Supply of loanable funds from households: Q = (10/3)r

Initially assume that this economy is a closed economy and that the government in this economy has a balanced budget.

Problem 21. Given this information, if the government decides to run a deficit of $140 we know with certainty that

a. The equilibrium interest rate in the loanable funds market will be greater than 6% and that the level of private investment is less than 20.

b. The equilibrium interest rate in the loanable funds market will be equal to 6% and that the level of private investment will be equal to 20.

c. The equilibrium interest rate in the loanable funds market will be less than 6% and that the level of private investment is less than 20.

d. The equilibrium interest rate in the loanable funds market will be less than 6% and that the level of private investment is greater than 20.

Problem 22. Given the initial information, if the government decides to run a surplus of $25 we know that

a. Private investment will be crowded out by $25.

b. Private investment will increase by $15 from its original level.

c. Private investment will be unaffected by the government running a surplus.

d. The increase in private investment that occurs is only possible with a decrease in household consumption.

Problem 23. Michael and Betty make a financial transaction where Michael borrows $10,000 from Betty with a promise that he will repay the amount of the loan plus 10% interest a year from now. Both Betty and Michael expect that inflation will be 5% over the course of this next year. Given this information and holding everything else constant,

a. If the rate of inflation is actually 8%, then Betty will be better off.

b. If the rate of inflation is actually 3%, then Betty will be better off.

c. If the rate of inflation is actually 5%, then Betty will be better off.

d. At the end of the year Betty will pay Michael $1000.

e. At the end of the year Betty will pay Michael $1100 unless the rate of inflation is not equal to 5%.

Problem 24. Suppose an economy is at full employment. Holding everything else constant, when the government runs a deficit this results in

a. Crowding out of private investment.

b. An increase in private saving.

c. A decrease in consumption by households.

d. Answers (a) and (c) are both correct.

e. Answers (a), (b), and (c) are all correct.

Problem 25. Consider a community that has eight individuals:

- Bobby who is 26 and is a full-time student studying computer science

- Emily who is 15 and works twenty hours a week at a local restaurant

- Susie who is 35 and has re-entered the labor market but is still looking for a job: she is available to work and she is applying for jobs

- Michael who is 54 and is currently unhappily employed as a CPA

- Sharon who is 62 and has recently lost her job due to changes in the technology used to produce widgets: Sharon is looking for work, available to work, and is applying for jobs

- Jo-Jo who is 17 and works part-time for ten hours a week at the local mall

- Pedro who is 33 and owns and operates a large plumbing business

- Xun who is 44 and works for a bakery fifteen hours a week

Given the above information, the labor force participation rate is equal to ______ and the unemployment rate is equal to ______. Round to the nearest whole number for both answers.

a. 86%; 33%

b. 75%; 33%

c. 75%; 25%

d. 100%; 25%

e. 100%, 33%

III. Problems

1. (worth a total of 15 points)Consider an economy whose aggregate production function can be described by the following equation where Y is real GDP, K is units of capital, and L is units of labor:

Y = 10K1/2L1/2

Furthermore, in this economy you know that the level of capital is constant and equal to 100 units. You also know that the labor market for this economy can be described by the following equations where L is the number of units of labor and W is the wage rate:

Labor Demand Equation: L = 800 - 20W

Labor Supply Equation: L = 20W

a. Given the above information, what is the equilibrium wage rate and the equilibrium level of employment in this economy? Show how you found your answer for full credit.

b. Given the above information, calculate the full employment level of real GDP. You can assume that when the labor market is in equilibrium that the full employment level of labor is being hired. Show your work for full credit.

c. Calculate the value of labor productivity when this economy is at its full employment level of real GDP. Provide any formulas you use in making this calculation. Show your work for full credit. In your answer provide the units of measurement for this calculation as well as the numeric value.

d. Calculate the value of capital productivity when this economy is at its full employment level of real GDP. Provide any formulas you use in making this calculation. Show your work for full credit. In your answer provide the units of measurement for this calculation as well as the numeric value.

e. In the space below draw two graphs indicating in the first graph the labor market and in the second graph this economy's aggregate production function. Label all axes, all curves, and all significant points in these two graphs. Make sure you indicate where the full employment level of real GDP is in your graphs.

f. Suppose that capital increases to 144 units. If there are no changes in the labor market, what will be the new full employment level of real GDP? Calculate the new level of capital productivity and provide a verbal explanation of what has happened to capital productivity.

Problem 2. Use the following information to answer this set of questions. The table below provides some data on the production of goods in 2010, 2011, and 2012 in Lattia, a small economy. For this problem assume that Lattia produces only sandwiches, apples and brownies.

|

|

2010

|

2011

|

2012

|

|

Quantity of Sandwiches

|

10

|

20

|

20

|

|

Price of Sandwiches

|

$2

|

$2

|

$3

|

|

Quantity of Apples

|

5

|

10

|

5

|

|

Price of Apples

|

$1

|

$2

|

$1.20

|

|

Quantity of Brownies

|

20

|

10

|

10

|

|

Price of Brownies

|

$3

|

$3

|

$3

|

a. Calculate the value of nominal GDP for 2010, 2011, and 2012. Provide a general formula for nominal GDP and once you calculate your values place your answers in the following table.

|

Year

|

Nominal GDP

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

b. Calculate the value of real GDP for 2010, 2011, and 2012 using 2010 as the base year. Provide a general formula for real GDP and once you calculate your values place your answers in the following table.

|

Year

|

Real GDP

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

c. Calculate the GDP deflator for 2010, 2011, and 2012 using 2010 as the base year and a 100 point scale. Provide a general formula for the GDP deflator and once you calculate your values place your answers in the following table.

|

Year

|

GDP Deflator with Base Year 2010 and measured on a 100 point scale

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

d. Based upon your calculation of the GDP deflator was there inflation in this economy during the three year period under consideration? Explain your answer and provide numerical expressions to support your answer. (No need to reduce this expression to a numerical value!)