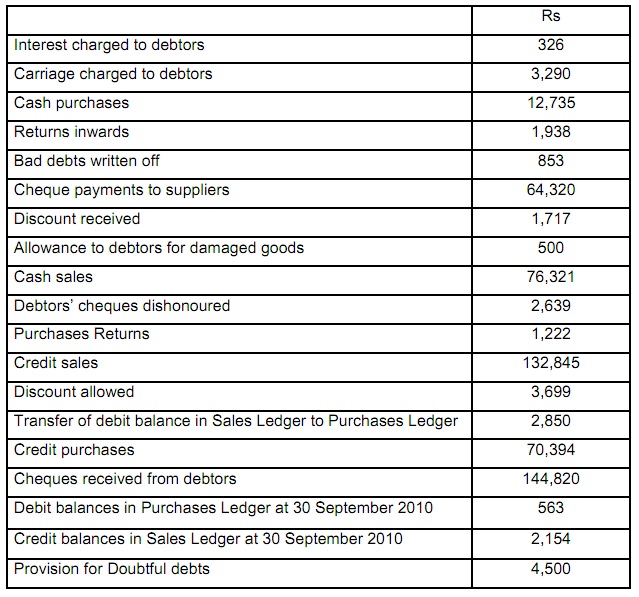

Question 1: The given information associated to Mr. William for the year ended 30 September 2010:

Balances in the books of Mr. William at 1 October 2009:

Sales Ledger

Debit: Rs 43,628

Credit: Rs 1,240

Purchases Ledger

Debit: Rs 324

Credit: Rs 24,695

Required:

a) The Purchases Ledger Control Account and Sales Ledger Control Accounts for the year ended 30 September 2010.

b) Describe in brief how a contra entry might occur.

Question 2: Waits opened a business bank account with Rs 16,000 on 1st April 2010. Throughout April issued cheques totaled Rs 72,760 and banked cheques totaled Rs 80,060.

These transactions were entered into his cash book up to 30th April 2010. On receiving statement for April he discovered the given:

a) A cheque for Rs 4,800, that was banked (and comprised in the receipts above), had been returned by the bank marked, ‘No funds available’. No adjustment was made in the cash book.

b) Bank charges debited on the bank statement for April amounted to Rs 600. No entry for such has been made in the cash book.

c) Cheques totaling Rs 16,860 was recorded in the cash book and sent to suppliers, to be presented to the bank until May 2010.

d) Cheques totaling Rs 12,100 had been entered into the cash book however was not credited in the bank until May 2010.

Required:

Compute the corrected bank balance which must appear in the business cash book 30th April 2010 and make a bank reconciliation statement at 30th April 2010.