Question 1. Use a diagram to explain the “new economics” proposition of monetary policy effectiveness. Describe the underlying assumptions of the new economics model. What is the policy ineffectiveness proposition?

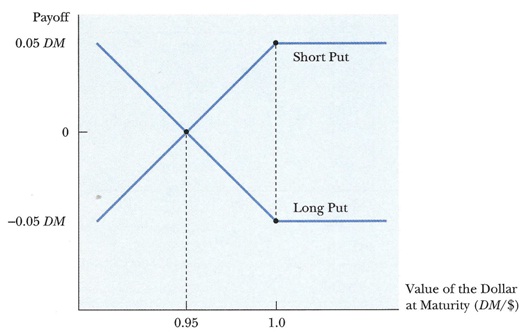

Question 2. Use the following figure:

a. to demonstrate the gains and losses to a short put and a long put on dollars with identical maturity dates, where the strike price is 0.50DM/$1, and the option premiums are identical at 0.05DM. Is there a net gain to short and long puts in this example? Why or why not?

b. Will a short put be exercised if the market price at maturity is greater than the strike price? Why or why not? Will a long call be exercised if the market price at maturity is lower than the strike price? Why or why not? Use properly labelled diagrams to support your answers. Assume that the strike price on each option is 4.2DM/$1, and that the option premiums are identical at 1.1DM/$1.

c. Explain the motives of both the seller and buyer of a straddle. Use properly labelled diagrams to support your explanation. Assume that the strike prices are 0.50DM/$1, that the option premiumon the call is 0.05DM/$1, and that the option premium on the put is 0.035 DM/$1.