Question 1. Monopoly

Madison Gas and Electric (MG&E) is a monopoly firm that provides electricity in Madison. Its total cost and marginal cost functions are given by the f ollowing equations where Q is quantity measured in megawatts:

TC = 4Q2� � + 400Q� + 10000

MC = 8Q + 400

The demand for electricity is given by the followin g equation where P is the price per megawatt:

Q = 2000 – P/2

a. Find MG&E’s marginal revenue function. That is, wri te an equation for MG&E's MR function.

b. Find the profit maximizing price and quantity. Show your work as well as your reasoning for finding these two answers.

c. Calculate the values of consumer surplus, producer surplus and DWL under monopoly. Suppose that the governor of Madison decides to impose MC regulation on MG&E. That is MG&E has to set a price that is equal to its marginal co st under this new regulation.

d. Find the equilibrium price and quantity under this new regulation. Calculate consumer surplus and producer surplus. Show your work and your reaso ning.

Question 2. Price discrimination Microsoft is a dominant firm in Operating Systems (OS) market. Microsoft knows that there are two types of users in the market: business users and pe rsonal users. Their demand curves are given by the following equations where Q is the quantity of oper ating systems and P is the price per system:

Business user: Q = 200 – P/2

Private user: Q = 150 – P/3

Once Microsoft develops its OS, production of an ad ditional unit does not cost anything to Microsoft, i.e. the marginal cost of OS is 0. Assume for now t hat Microsoft can price discriminate, i.e. it can charge different types of consumers different prices.

a. Derive the profit maximizing prices (there should be two different prices) for business and personal users. What is Microsoft’s total profit gi ven these prices (to find this you will need to determine how many units of OS Microsoft produces)?

b. Derive the sum of consumer surpluses and producer s urpluses in equilibrium when Microsoft price discriminates by charging different prices to these two consumer groups. You will find it helpful to draw graphs illustrating the markets you are analyzing.

c. Suppose that consumers are able to trade among them selves, i.e. personal users are able to sell their OS to business users and vice versa. If this is the case, can the prices you derived in part (a) be the equilibrium prices? Make a verbal argument t o support your reasoning. Assume now that the Federal Trade Commission (FTC) does not allow Microsoft to price discriminate.

d. Derive the market demand function for OS given the assumption that Microsoft no longer price discriminates. e. Derive the marginal revenue function that correspon ds to the aggregate demand curve.

f. Find the profit maximizing price and quantity when price discrimination is not allowed. Calculate the value of consumer surplus. Show your work and your reasoning for these calculations. You will definitely find it helpful t o draw a graph to see the area of CS.

g. Assume that the objective of the FTC is to maximize consumer surplus. Should FTC prohibit price discrimination? Explain your reasoning.

Question 3. Game Theory Coke and Pepsi are two big firms competing in a bev erage market. Since Coke and Pepsi are substitute goods, the demand for Coke increases as the price of Pepsi increases and the demand for Pepsi increases as the price of Coke increases. As a result, their demand curves are given by �:

Qcoke = 100 �- Pcoke + �Ppepsi/2, � � ���

Qpepsi = 100 �- Ppepsi + �Pcoke/2, � �

The total cost of producing q quantity of Coke or P epsi is given by 20q.

a. What are Coke and Pepsi’s profits when they both se t the price equal to $80? Show how you found your answer.

b. What are Coke and Pepsi’s profits when they both se t the price equal to $100?

c. What are Coke and Pepsi’s profits when Coke charges $80 and Pepsi charges $100 for its product? Now assume that the two firms set the prices simult aneously. They can either set P=80 or P=100. Let πcoke be Coke ‘s profit and πpepsi �be Pepsi’s profit.

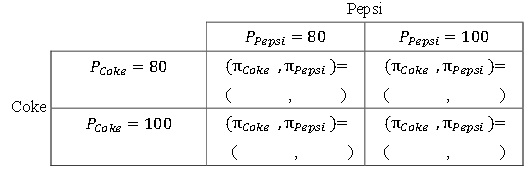

d. Using your solution from previous parts, complete the table below.

Does the game you mapped out in (d) have an equilib rium? Explain your answer.

Question 4. Public Good:

a. Find one example of a public good from the real wor ld and argue why it can be classified as a public good.

Suppose there are three types of consumers with dif ferent demand curves for public goods in the market. The following equations provide the demand curves for each group of consumers of this public good where P is the price per unit of the pu blic good and Q is the quantity of units of the 4 public good:

Group One: P = 100 – Q

Group Two: P = 50 – Q/2

Group Three:P = 75 – Q/2.

The cost of producing public goods in this example is constant and is given by the following equations where TC is total cost and MC is marginal cost:

TC = 50Q MC = 50

b. By vertically summing the three demand curves, deri ve the market demand curve for the public good.

c. Find the socially optimal level of the public good. Also, find the total price of each unit of the public good. Show your work.

d. In order to achieve the socially optimal level of a public good in the market, what price should each group of consumers pay? Show how you found your answer.

Question 5: Externality

George Smith gains benefits from hosting a loud par ty. His marginal private benefit (MPB) and marginal private cost (MPC) of hosting T hours of a party are given by the following equations:

MPB = 30 – T

MPC = 2T

Both MPB and MPC are measured in dollars per party hour. George's neighbor hates loud parties and thus, he incurs a cost of $15 per hour for each hour that George has a party.

a. If there is no regulation of loud parties in the co mmunity, how long will George Smith’s loud party last? Show how you found your answer.

b. Is the answer you obtained in part (a) a socially o ptimal level of loud party? Explain your answer.

c. Since holding a loud party imposes a cost both on G eorge Smith and his neighbor, the marginal social cost (MSC) is given by the sum of MPC and th e external cost. Derive the MSC and find the socially optimal level of T. Show your work.