Question 1)

Derive the pricing formula for the expected excess return of a risky stock and the riskfree stock in the traditional consumption-CAPM assuming that the level of habit Ht depends on the time t-1 agent’s and the society consumption levels (Ct-1 and ‾Ct-1), that is:

Ht = Cλ1t-1 C‾λ2t-1

were λ1 and λ2 are elasticities of Ht with respect to Ct-1 and Ct-1 (constant parameters).

Question2)

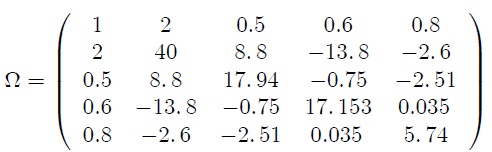

In a market where the CAPM holds there are five risky assets with the following attributes per year.

Asset 1 2 3 4 5

Expected return 5% 3% -1% 6% 0%

Market capitalisation (in millions of $) 2.2 3 4.6 1.2 5

a) Calculate the expected return on the market portfolio and the market risk assuming that the portfolio weights are equal.

b) Calculate the expected return on the market portfolio and the market risk assuming that the portfolio weights are proportional to the asset’s market capitalisation.

c) Calculate the expected return on the market portfolio and the market risk using mean-variance model.

d) Which of the three strategies is the best.

e) Do 1, 3 and 4 assuming that the risk-free rate is r = 1% with a weight wf = 0.2.