Question 1:

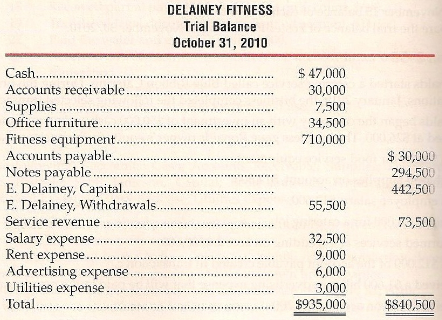

The trial balance for Delainey Fitness, shown below, does not balance. The following error were detected:

a. The cash balance is overstated by $6,000.

b. Rent expense of $3,000 was posted as a credit rather than a debit.

c. The balance of Advertising Expense is $4,500, but it is listed as $6,000 on the trial balance

d. A $9,000 debit to Accounts Receivable was posted as $900.

e. The balance of Utilities Expense is understated by $900.

f. A $19,500 debit to the E. Delainey, Withdrawals account was posted as a debit to Delainey Capital.

g. A $1,500 purchase of supplies on account was neither journalized nor posted.

h. An $87,000 credit to Service Revenue was not posted.

i. Office furniture should be listed in the amount of $19,500.

Prepare the corrected trial balance at October 31, 2010. Journal entries are not required.

Question 2:

Ryan Kessler operates a heavy equipment transport company, Kessler Transport. The com¬pany had the following transactions for the month of August 2010:

Aug. 1 Kessler Transport received $20,000 cash and a truck and trailer from Kessler.

The truck had originally cost Kessler $300,000, but had a fair market value of $230,000 on August 1. The trailer had a fair market value of $30,000.

3 Purchased a new trailer by paying $10,000 cash and promising to pay another $20,000 in one week. The trailer had a list price of $40,000 and Kessler knew it was worth at least $35,000.

4 Paid parking space rental fees of $400 for the month of August. These fees covered three spaces-two for the trailers and one for the truck.

5 Hired an assistant at a rate of $750 per week.

9 Transported equipment for clients for $3,200. They paid $1,600 and promised to pay the balance in 30 days.

10 Paid $6,000 of the amount owing on the trailer purchase on August 3. Signed a promissory note for the balance, as the company was unable to pay the full amount that day.

15 Paid Kessler's personal telephone bill for $110. Treat this as a withdrawal.

20 Received $1,600 from the clients of August 9 as payment on the haulage.

26 Paid the assistant for three weeks' work.

29 Billed a client $6,000 for hauling equipment from Prince Albert to Saskatoon. The client, who was the owner of a service station, paid the bill by providing the company with $6,000 of repair parts that can be used on the truck.

30 Used $60 of repair parts on the truck (a truck operating expense).

Required: Record each transaction in the journal. Identify each transaction by its date. Explanations are not required.